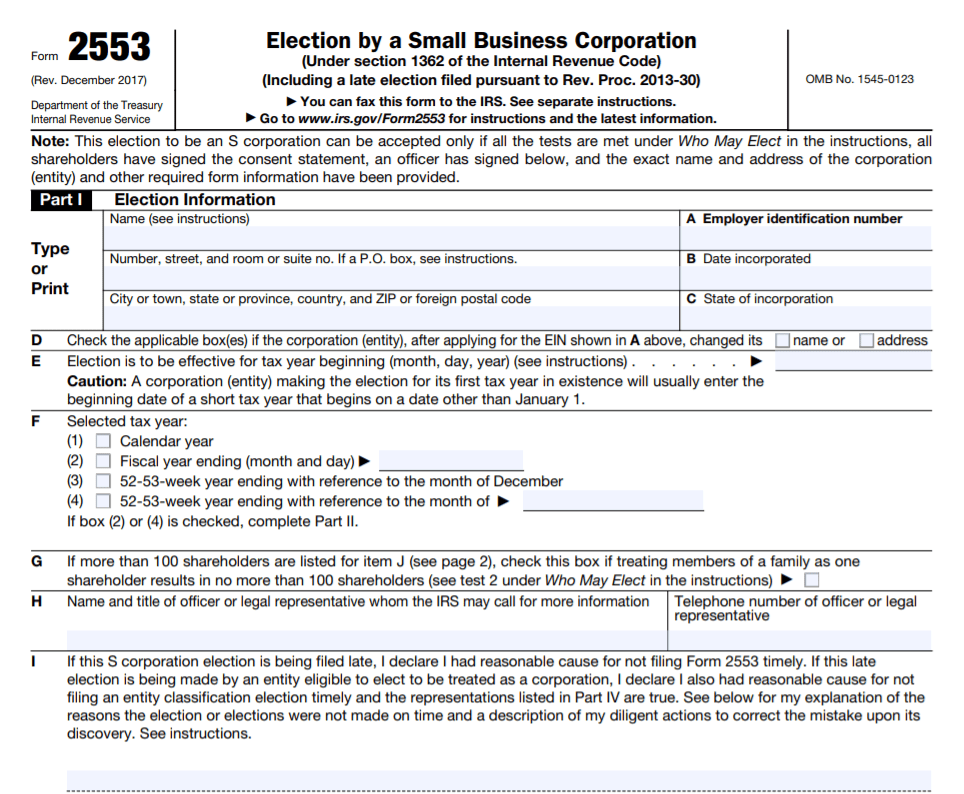

If you registered your business as a corporation, the IRS automatically makes you a C-corp. This has many tax disadvantages, making it hard for small businesses to remain profitable. Fortunately, businesses can file IRS Form 2553 and choose to be an S corporation instead.

The largest benefit of filing as an S-corp is the tax savings. The shareholders bear the burden of the corporation’s net income, paying taxes at their personal tax rate rather than the corporate tax rate, which is 21% plus the personal tax rate of any earnings.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

What’s is the IRS Form 2553?

IRS Form 2553 tells the IRS you want to file your corporation’s taxes as an S-corp rather than a C-corp. Once you complete the form and send it to the IRS, they will review it and respond with an approval or denial in writing.

Before you can file as an S-corp, you must incorporate your business. Follow your state laws to determine the necessary steps.

Once incorporated, your corporation is automatically filed as a C-corp, but you can request otherwise with this form.

Example Scenario for Form 2553

John opened a company and decided to incorporate it. The IRS automatically assigned him as a C-corporation. John’s company owed taxes on the company profits, plus the profits he personally earned. This means John paid double taxes (taxes for the company and personal taxes on the money he personally earned from the company).

John decided this wasn’t ideal and would rather operate as a pass-through entity. He filed Form 2553 at the start of the next tax year and was approved. Now the profits of John’s company are all taxed on his tax return, not just the profits that he withdraws. However, he only pays taxes at his personal tax rate on all company profits. He doesn’t owe the corporate taxes plus his personal taxes on his portion of the earnings.

Frequently Asked Questions

Let’s go through a few of the most commonly asked questions with this tax form.

Does the IRS accept electronic signatures on Form 2553?

The IRS does accept electronic signatures on Form 2553. At least one corporate officer must sign it and all corporate shareholders must provide written consent.

Where do I fax IRS Form 2553?

The IRS has two fax numbers depending on where the corporation is located. Check here to see which number applies to your business.

How do I file IRS Form 2553 online?

You cannot file Form 2553 online. The IRS only accepts submission via mail or fax. If you submit via fax, make sure you keep the original with your company records.

When should I file Form 2553?

IRS Form 2553 is due by the 75th day of the tax year (3rd month of your tax year). It is effective for 12 months after approval. It is also good for 75 days prior to the filing.

You can file the form any time before the tax year you want the s-corp to be valid.

If your tax year is 2 ½ months or less (you open mid-year), you must file by the 15th day of the second month of operation.

Is there a fee to file Form 2553?

You’ll be happy to know that there is no fee to file Form 2553.

Remember: Keep track of your expenses and income on a spreadsheet or bookkeeping program such as FreshBooks.

8 Tips to Help You with Registering Your S-Corp

1. Know Why You Should Use an S-corp for Your Business

The largest advantage of filing as an S-corp is the pass-through taxation. The income, expenses, and deductions pass through to the owners. This decreases the company’s tax liability and your personal tax liability too.

2. Know the Filing Requirements for an S-Corp

You can only file as an S-corp if you meet the following:

- Your business is domestic

- Your business has fewer than 100 shareholders

- Your business only has one class of stock

3. Don’t Miss the Filing Date

You may be eligible to file Form 2553 late, but only if you accidentally missed the filing date and not because you were ineligible to file as an S-corp.

Also, you cannot file late because you didn’t qualify at the time. You must provide reasonable cause for the missed filing date, but the IRS is fairly lenient in this regard.

The most commonly accepted reasons for filing IRS Form 2553 late are that the CEO (or CFO) forgot to file on time or your tax advisor forgot to file on time.

4. Follow the Standard Fiscal Year

The IRS requires S-corps to follow a standard fiscal year. But if your business doesn’t follow a fiscal year, you must provide ample evidence why.

One of the most common reasons is following a natural tax year that follows the company’s busy and slow season versus a calendar year.

5. Speak with Your Tax Advisor

Talk to your tax advisor about any state specific regulations. Filing as an S-corp is at a federal level, but some states have special tax treatment or specific filing requirements.

6. Know Which Businesses that Do Not Qualify

Some businesses are not eligible for an S-corp filing. They include banks, insurance companies, and companies that make international sales.

7. Know How Long to Wait for the IRS

Once you file IRS Form 2553, it takes up to 60 days for the IRS to respond. If you’re approved, the IRS sends a CP261 Notice. If your request is denied, you’ll receive a CP264 Notice.

The notice won’t tell you why you were denied, though. You must call the IRS to discuss the situation.

8. Know How to Get In Contact with the IRS

If you lose your copy of IRS Form 2553 after you become an S-corp, call the IRS hotline at 1-800-829-4933 to request your copy. You’ll need proof of your identification and your role within the company to get the copy.

File with Ease from Home Today!

Bottom Line

If you want to change your corporation’s tax status, you must file IRS Form 2553. The S-corp status offers many tax benefits and it’s not hard to file on your own.

The IRS provides simple instructions to help you get through the form and then you just wait the 60 days to find out the response. Filing early is your best bet so you can work out any issues should they arise.

I hope this article helped you gain some control of your tax plan this year. Remember not to stress out. Don’t forget to check out Tax Forms page for any additional online tax checklists and forms you may need this year.

If you like this article, then you’ll love these:

- What Are Tax Exemptions? Everything You Need to Know

- 1098 vs 1099 – Which Tax Form Will Save You the Most this Year?

- 2024 Tax Benefit Rule: See How It Can Save You Thousands!

- Decoding the Mystery: Are Pell Grants Taxable Income?

- Avoid a TAX NIGHTMARE: Uncover Whether Car Accident Settlements are Taxable

Get started on your taxes early here!

Until the next money adventure!

Handy

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**