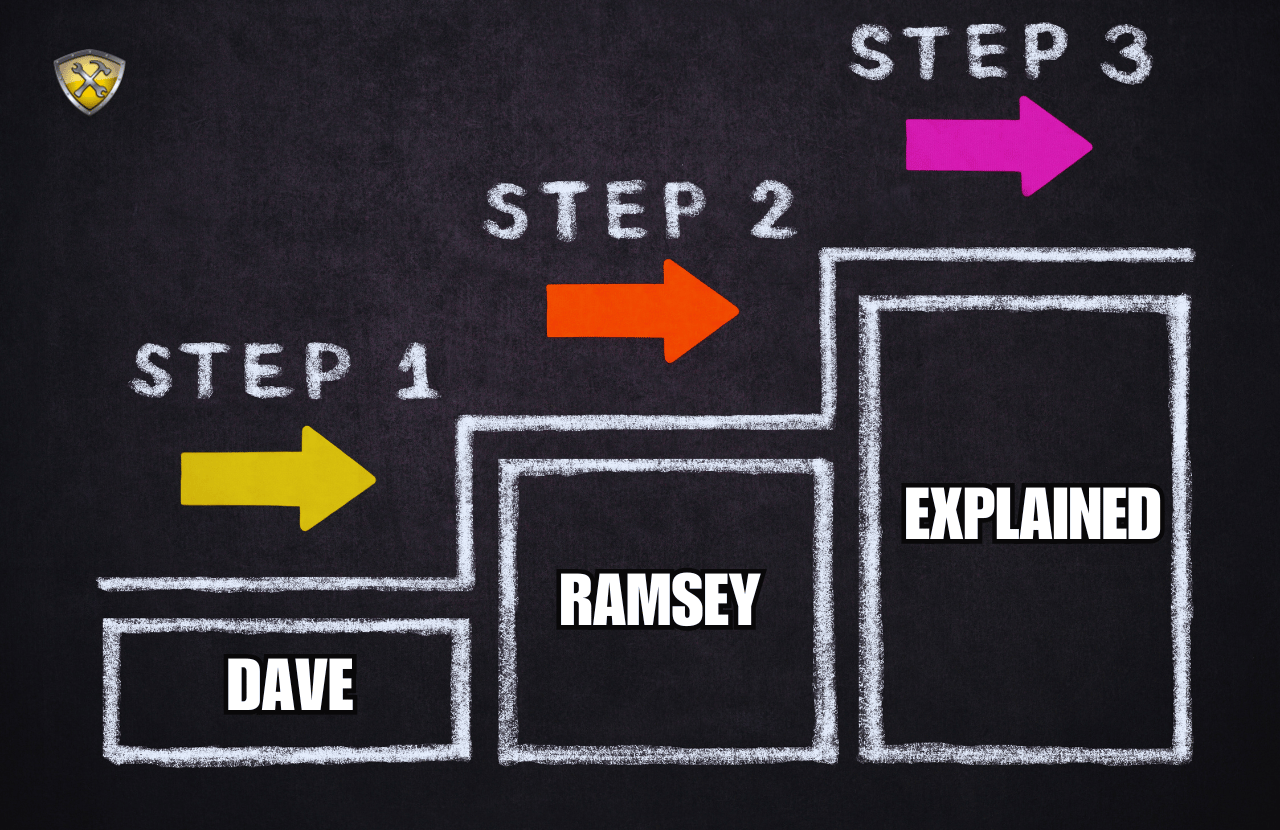

First-timer’s Guide to the Dave Ramsey Baby Steps Plan: Everything You Need to Know to Be Successful!

Have you ever wondered if the Dave Ramsey Plan could really work for you? Don’t worry, I was a skeptic ...

23 Easy Ways to Save Money on a Tight Budget (How to Save Money Fast in 2025)

Have you been asking yourself, “what’s the quickest way to save money on a tight budget?” I totally understand where ...

How to Save $3,000 in 6 Months: Easy Ways to Save Money Fast!

Do you think it’s hard to save $3000 in 6 months on a low income? Saving money can be a ...

Uncover the Ultimate Money-Saving Tips: 23 Hacks Every Millennial Needs to Know!

Are you trying to figure out the most realistic money saving tips for you to use today? Millennials are a ...

2024 Tax Benefit Rule: See How It Can Save You Thousands!

Have you ever stumbled upon a phrase in the tax world and wondered, “What is the tax benefit rule?” Well, ...