Have you ever wondered if the Dave Ramsey Plan could really work for you?

Don’t worry, I was a skeptic just like you when my girlfriend (now wife) first told me about it.

You probably already know that personal finance is an ever-growing topic because it has an affect on everyone. Every individual is exposed to money in some capacity and it is important to understand how it works.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

Who is Dave Ramsey?

As with anything, there are self-help personalities, gurus and people who claim to have the secret to a winning formula. It can be difficult to find an individual that is genuine and provides a no-frills type of approach, but Dave Ramsey fits that bill.

He has been through a bankruptcy and has felt the pain many Americans are feeling on a daily basis.

Dave Ramsey is a personal finance personality who created a plan that is simple in nature and is effective at helping individuals and families eliminate debt.

In his book, The Total Money Makeover, he lays out the Baby Steps, which are 7 steps to help and guide you through the process of eliminating debt and building wealth.

How Do I Start the Dave Ramsey Plan?

The first step in making this life changing decision is to first recognize that you are tired of living paycheck-to-paycheck and that you truly want to change your future.

I will not say that this process is super easy, but I will say that it is totally worth every bit of sacrifice and discipline that you put into it.

As you go through this overview of the Dave Ramsey plan, you should leave feeling confident that it is something you can definitely accomplish if you’re ready to really live like no one else.

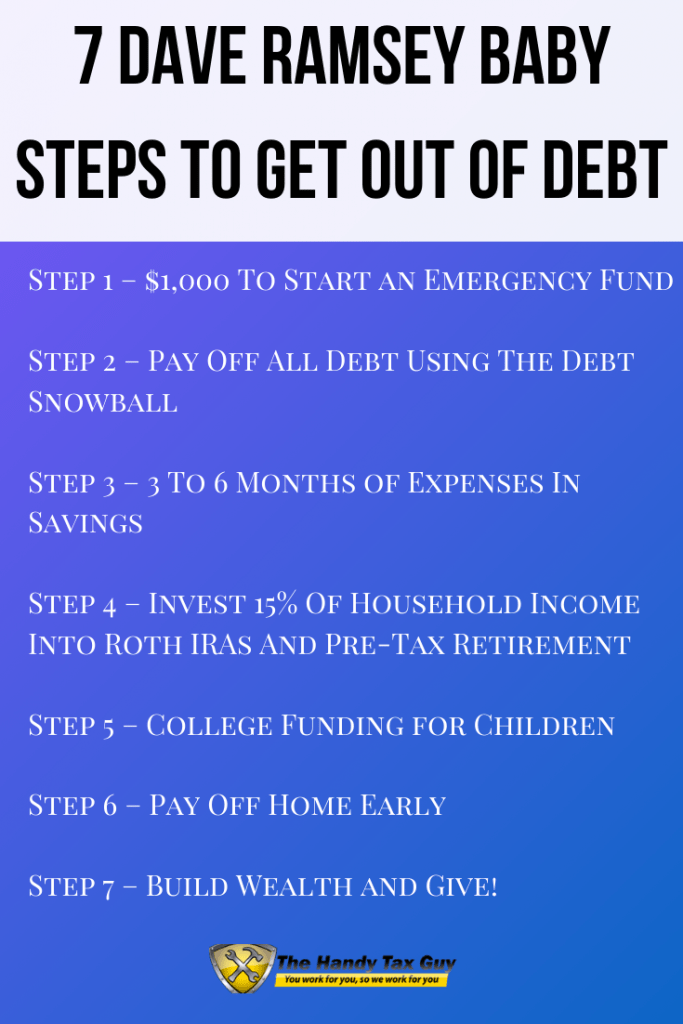

What are the 7 Baby Steps of the Dave Ramsey Plan?

- Baby Step 1 – Start an Emergency Fund ($1000)

- Step 2 – Use the Debt Snowball Method to Pay Off Debt

- Baby Step 3 – Put 3 to 6 Months of Expenses Into Savings

- Step 4 – Invest 15% Of Household Income Into Roth IRAs + Pre-Tax Retirement

- Baby Step 5 – Start College Funding for Children

- Step 6 – Pay You Home Off Early

- Baby Step 7 – Build Wealth, Give and Live in Financial Peace!

Dave Ramsey Debt Snowball Breakdown – Baby Steps List

Now that you know what to expect from each aspect of this Dave Ramsey Financial Peace area, let’s go through what you should know about each Baby Step.

Dave Ramsey Baby Step 1 – Starter Emergency Fund

The first step is to build a small emergency fund of $1,000. This isn’t acting as your full-blown emergency fund, but rather act as a buffer between you and the unforeseen incidents of life.

Some individuals bump up the start emergency fund to $2,000 but the idea is to not spend much time on this step.

How this is used is if your car needs an emergency repair or you become unexpectedly ill, you have this money available to use.

With the emergency fund in place, it eliminates the need to use a credit card and stops the debt mountain from increasing in size.

Get started on your emergency fund with The Handy Tax Guy’s Savings Plan Workbook!

Dave Ramsey Baby Step 2 – Debt Snowball

Utilizing the debt snowball is simple, in that you list all of your debts from smallest to largest and begin putting all of your energy on the smallest.

The reason for this is it allows you to see tangible results quickly, in turn, fueling your motivation to eliminate debt.

Once you’ve paid off a debt, you take all of the money you were putting towards the first debt and lump it into the next. This pattern continues until you are out of debt.

Is the Debt Avalanche different from the Snowball Method?

While Dave Ramsey doesn’t waiver on this, you can utilize what is known as a debt avalanche, which is the same idea but instead of listing your debts smallest to largest by balance, you do so by interest rate.

The idea is to keep momentum going as Baby Step 2 can be the most difficult.

Dave Ramsey Baby Step 3 – Fully Funded Emergency Fund

The next Baby Step is to begin completely funding your emergency fund. Funding your emergency fund should cover 3-6 months worth of living expenses in the event all other incoming money suddenly stops.

Having this in place will not only stop you from going back into debt, but will give you the peace of mind knowing should something happen you have the funds available to cover it.

One thing to note is when saving your emergency fund do not invest the cash. These funds should be liquid in the event you need the money right away.

In a brokerage account you have to wait a few days before your funds become available after selling an investment.

Dave Ramsey Baby Step 4 – Invest 15% of Your Income into IRA’s/401k’s

At this point in the journey you are well out of debt and should be on your way to building wealth.

Here is when you want to begin utilizing pre-tax wealth building vehicles such as your 401k and IRA. Ideally, you would max both of these out annually and let compounding work its magic.

What to specifically invest in is up to you, but Dave does recommend good growth mutual funds.

Vanguard is a reputable name in this space, but everyone’s investment decision making is different and it’s up to you to decide what fits your needs best. At this point, you can always reach out to a financial advisor or financial planner for their advice as well.

Dave Ramsey Baby Step 5 – College Funding for Children

As you might guess, Baby Step 5 is fairly straightforward in that you should save money for your child or children’s education.

There is no hard-fast rule as to how much to save as that is ultimately up to you. If you don’t have children then you can eliminate this step all together.

There are various college saving plans out there, but depending on how you feel you can use a savings account, brokerage account, or a college savings plan.

Dave Ramsey Baby Step 6 – Payoff Your Home

Now that you have all of your finances in order, it is time to tackle to big one, your home. The goal is to payoff your home as quickly as possible, putting all money towards it, turning your home into an asset.

For those of you in a 30-year mortgage, Dave Ramsey recommends refinancing into a 15-year if the numbers make sense.

If you are a first-time home-buyer, you should initially plan for a 15-year fixed mortgage with 20% down. The 20% down will eliminate the need to PMI or Private Mortgage Insurance, which simply protects the lender in the event you default.

Once your home is paid off, you have effectively eliminated all debts and are 100% financially free!

Dave Ramsey Baby Step 7 – Build Wealth and Give

The last and final step is to continue building life changing wealth and giving back to the community and causes you believe in.

This is effectively the reward phase of all your hard work as you can watch your money grow and know you have changed your family tree.

Continue maxing out contributions into your pre-tax retirement accounts and building wealth how you see fit.

Final Thoughts on the Dave Ramsey Plan

The Dave Ramsey plan is easy to understand with no surprises and a straightforward logic. Understanding your money and sticking to a written budget are some of the most difficult parts because you can be your own biggest obstacle.

Once you gain momentum and see the changes, you’ll understand the power of living debt free!

The Dave Ramsey Plan has given my family a way to invest in our dreams because we don’t have the stress of debt holding us in bondage.

I hope this breakdown of the Dave Ramsey program help you change your financial future and create the life you deserve!

Let us know if you’ve ever use the Dave Ramsey plan to get out of debt in the comments section below.

If you enjoyed this article, then you’ll love these:

- How to Save Money Fast: $3K in Six Months

- Why a Tax Preparation Checklist Will Make Your Life Easier

- 11 Amazing Ways to Make Your 2019 Tax Season Easy

- How to Save Money for Vacation without Breaking the Bank

For more money-saving tips and guides, subscribe to the weekly newsletter!

Until the next money adventure, take care!

Handy

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: January 7, 2019, Updated February 5, 2021)