Have you been asking yourself, “what’s the quickest way to save money on a tight budget?”

I totally understand where you’re coming from.

Saving money is an important part of personal finance but when your budget is ALREADY tight, it can be difficult to save money quickly.

Some of the factors that contribute to a tight cash flow include:

- consumer debt

- frivolous spending

- lack of financial education

Even with these factors, it is still more than possible to save money and begin contributing to your financial freedom!

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

8 Simple Ways to Save Money Each Month

This article will detail several different ways you can add to your savings on a tight budget. Once you begin saving, it should only get easier as time progresses.

According to Bankrate, 59% of Americans are uncomfortable with their level of emergency savings while 63% of people report saving less due to rising costs.

With those statistics, I thought it would helpful for me to give you a few realistic ways to actually save money this year.

1. Eliminate Unnecessary Spending

The first and easiest things you should address are the frivolous purchases made throughout the month.

For many (I’m not trying to call you out…well maybe I am), it includes spending money at a coffee shop or multiple trips to the fast food place down the road.

Stopping these purchases will result in an immediate and noticeable difference in your finances.

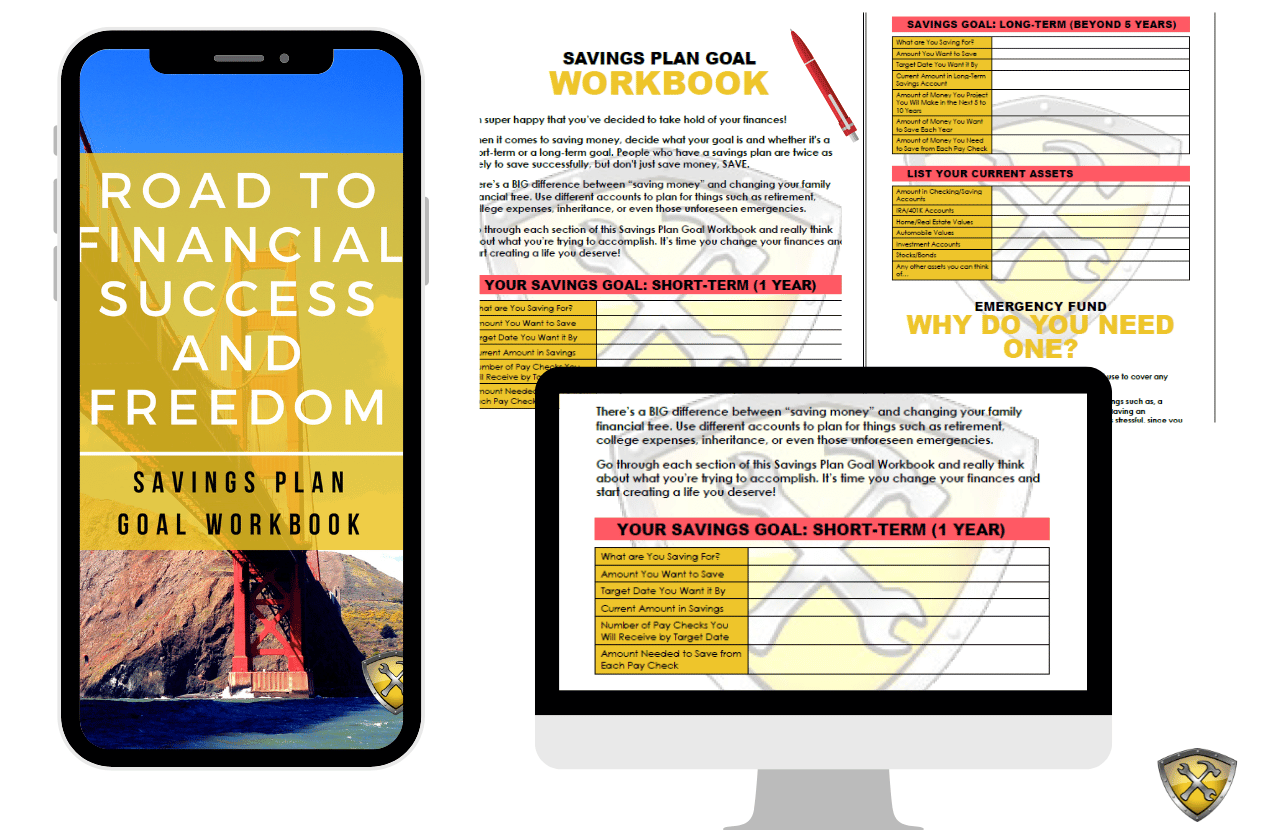

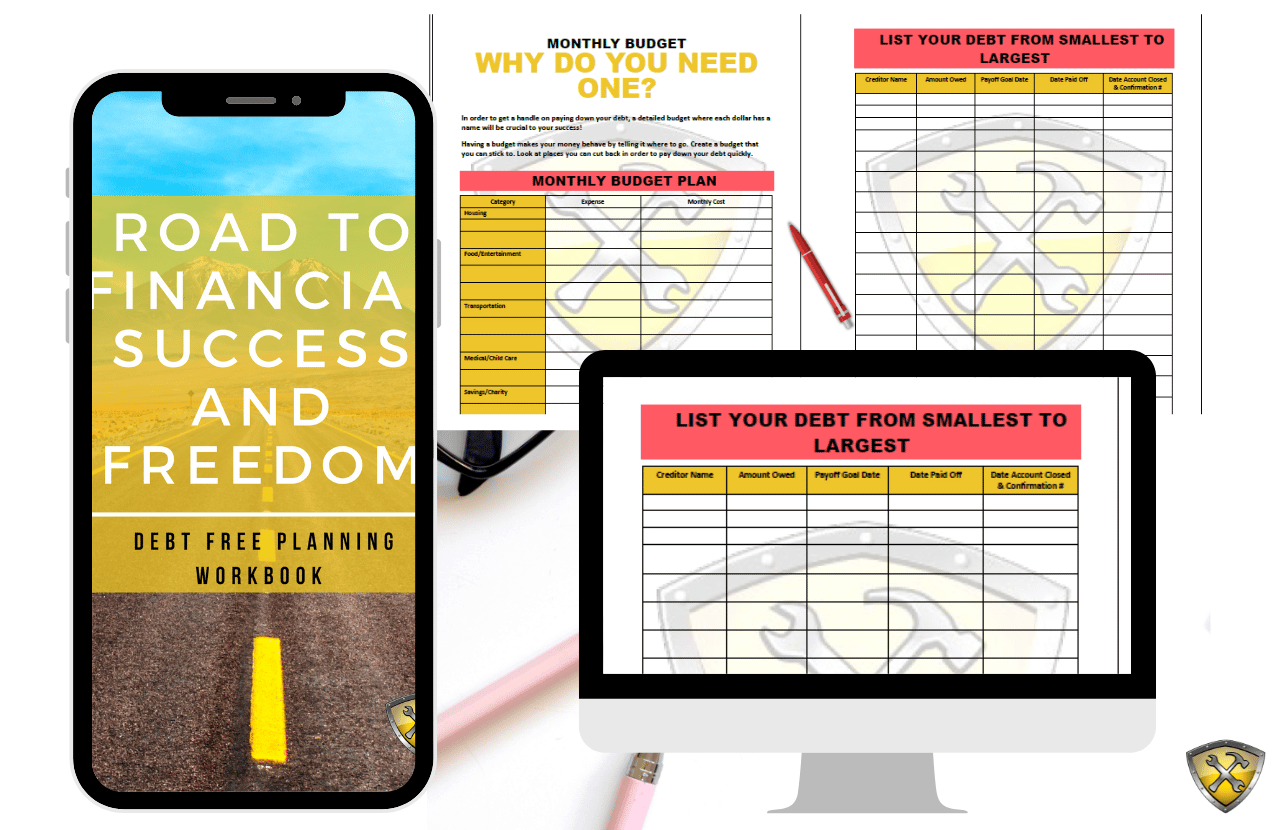

Save Money (even on a tight budget) with This ULTIMATE SAVINGS GUIDE!

2. Eliminate Debt

What you can do with those extra dollars you’ve saved by not spending is to first eliminate debt.

By eliminating debt, you FREE-UP future cash flow that can be used to build your wealth.

Also, if you don’t have a ton of debt, you can use that money for investing in your retirement or your child’s college fund.

How to Save Money Fast?

Take a glance at the chart below which details how you can save $1500 in just 3 months. It can be done if you are focused.

3. Sell Unwanted Items

If you find that saving money is difficult right now, you can generate extra cash by having a garage sale and selling your unwanted items around the house.

You’d be surprised at how much you can make from items lying around your house. This is usually where I start.

With platforms such as eBay or Facebook Marketplace, you can easily find someone who is looking for the items you’re selling.

Also, you can find that by flipping items you can generate more revenue.

Flipping items is simply finding items at garage sales or thrift stores that are underpriced and can be sold for a higher price elsewhere.

Similar to the unnecessary spending, once you’ve generated the extra cash flow you can either apply that to your savings or begin paying off your debt.

While this only works as long as you have items to sell, it is an effective way to begin saving for your future.

File Your Taxes with Ease from Home Today with TurboTax!

4. Use Cash-Back Apps

Cash-back apps like Rakuten and Ibotta offer a simple way to earn money back on everyday purchases.

By using these apps, you can receive cash back on groceries, online shopping, and more.

Over time, these small amounts can add up, providing a nice boost to your savings. It’s an easy and effective way to make your money work harder for you.

5. Eliminate Monthly Services

As technology has grown and evolved so have the options to clients.

For example, Netflix and Hulu have slowly replaced traditional cable and satellite television. Podcasts and YouTube offer alternatives for those looking to save money on their monthly bills.

To start you can eliminate cable as that continues to be an expensive portion of monthly costs.

Instead, look to using a monthly streaming service that is a fraction of the cost or better, cut all spending on television entertainment.

Use platforms such as YouTube or fill the void left behind by starting a business or freelance on a site like Fiverr.com.

If you’re a sports fan, you can visit a friend’s house or go to a place where they are televising the game to enjoy.

Also, review you cell phone bill as that is an easy place to save money.

You can do so by switching providers or paying off your current cellular device. Be sure you ask

about any discounts your provider may have if you’ve served in the military or on a police force.

6. Automate Your Savings

Automating your savings is a powerful way to ensure you consistently set aside money without having to think about it.

By setting up direct deposits into a high-yield savings account, you can effortlessly grow your savings over time.

This method leverages the principle of “paying yourself first,” ensuring that savings are prioritized before other expenses.

Many find that automating savings helps them avoid the temptation to spend money that could otherwise be saved.

7. Consider Prepaid Cell Phone Plans

Switching to a prepaid cell phone plan can be a smart move to cut down on monthly expenses.

Prepaid plans often offer the same services as traditional plans but at a fraction of the cost.

By evaluating your actual usage and needs, you can choose a plan that fits your lifestyle without overpaying for unnecessary features. This change can lead to significant savings over time.

Get your FREE Tax Refund Estimator TODAY!

8. Freelance or Have a Side-Hustle

Similar to a second job is to take on freelancing, which is simply allocating your free time to something you are good at.

Whether it be writing, accounting, starting a blog, building websites or being a virtual assistant, you can make extra money with a few hours of work while staying at home.

Having a side hustle is an effective way to generate income and help boost your savings potential. I started my own blog around theme parks which allowed me to leave my career as a Pharmacist to blog full-time!

A few websites you can use include Fiverr.com and Upwork.com. Both give freelancers a place to find work and promote their natural talents and make lots of extra cash.

The only drawback is it takes 2 weeks for the funds to clear so keep that in mind if you choose to go this route.

Recommended: How Our Co-founder, Nikida, Grew Her Blog From 0 to $10K+ a Month

15 More Ways for Living on A Budget Tips

- Set your budget up the right away

- Open up a bank account that’s only dedicated to saving for your vacation

- Set up an automatic transfer to your savings bank account (do weekly or bi-weekly transfers)

- Start using cash to pay for your daily expenses (think of the envelope system that Dave Ramsey speaks about and only budget a certain amount of money for day-to-day items…once it’s gone you have to wait for the next month to take more cash out)

- Take a break from buying coffee (instead make your own coffee at home)

- Keep your monthly food budget in check

- Become a meal planning pro

- Find gym alternatives to save money (work out from home or ask for deals at your current gym)

- Eat out less

- Remove big expenses from your budget like your outrageous rent/mortgage car (I know I’m being blasphemous right now, but could you sell your car and buy a cheaper car?)

- Get a part-time job

- Car pool to work with your co-workers (you guys can alternate the weeks of who will drive into the office or location)

- Download a savings app

- Rent out a room in your home

- Stay motivated while saving

Save Money (even on a tight budget) with This ULTIMATE SAVINGS GUIDE!

My Final Thoughts

Just in case those options may not work for you, here are other ways to save money on a tight budget:

- purchasing store brand groceries

- using free parks

- entertainment options

- bringing your lunch to work

Even though you may be on a tight budget at the moment, with a steady and purposeful attention to your spending, you’ll be able to loosen the restriction and feel your financial health improve.

By restricting your spending and even increasing your incoming cash flow, you can expedite the process to financial freedom!

I hope this breakdown helps you discover some additional money to save quickly. Let me know which savings idea is your favorite in the comment section below.

If you want more handy tax tips, then feel free to check out my latest articles here.

If you enjoyed this article, then you’ll love these:

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: March 4, 2019/Updated On January 4, 2025)