We’re nearing tax time and that means one thing – you must decide how you’ll complete your taxes. Will you go the DIY route or pay a CPA to do your taxes for you?

A common debate at tax time is TurboTax vs a CPA (Certified Public Accountant) – which is better and/or right for you? Check out this guide on the difference between the two and how to tell which option will suit you the most.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. Which means if you click on any of the links, I’ll receive a small commission at no additional cost to you.

TurboTax vs CPA Key Takeaways:

- Tax software comparison: When considering tax software comparison, it’s essential to evaluate both cost and features.

- TurboTax offers several pricing tiers, ranging from $0 to $170+

- CPA can be more expensive, with average fees around $350 for preparing an itemized 1040 and a state return.

- Tax planning strategies: CPAs can offer valuable tax planning strategies that software cannot.

- IRS audit support: TurboTax provides IRS audit support through its Audit Defense service.

- Financial complexity: As your financial complexity increases, the need for a CPA may become more apparent.

- Tax compliance tools: TurboTax is one of the leading tax compliance tools available today.

Keep reading to get everything you need to know about this tax comparison.

When Would I Need a CPA?

Using a CPA to file your taxes is important when you’ve had major changes in your life, or you have a complicated tax situation.

What makes a tax situation complicated varies by person, though. For example, you may run your own business and be perfectly comfortable filing your own taxes using TurboTax.

Your neighbor, however, may find it much too complicated and opt to hire a Tax Preparer or Certified Public Accountant (CPA).

Here are a few other situations when a CPA may be a good fit if you:

- Own multiple rental properties

- Bought or sold a business this year

- Got divorced or became a widow

- Bought or sold a large number of assets

A CPA can walk you through what you’d need to file your taxes given any complicated situations and can ensure that your taxes are file correctly, reducing the risk of an audit.

What is TurboTax?

TurboTax is tax software you can buy to do your taxes yourself. TurboTax is one of the most popular tax preparation software on the market today, although there are many other options too.

Anyone can use online tax software as long as they know what documentation they need and are capable of inputting the information into the program.

Once entered, TurboTax does the rest of the work for you. Even if you don’t know much about tax code, the program asks enough questions to get you through the process easily.

Is TurboTax Completely Free?

When comparing TurboTax vs a CPA, most people assume TurboTax is cheaper. In most cases it is; however, there maybe some circumstances where it can be cheaper to go to a CPA.

Is there a free version?

Yes, but not everyone is eligible. Only taxpayers with a ‘simple tax return’ are eligible. Basically, this means if you have only W-2s or unemployment income and take the standard deduction is TurboTax free.

If you don’t qualify for a free program, the costs might be higher than you’d expect.

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

How Much is TurboTax?

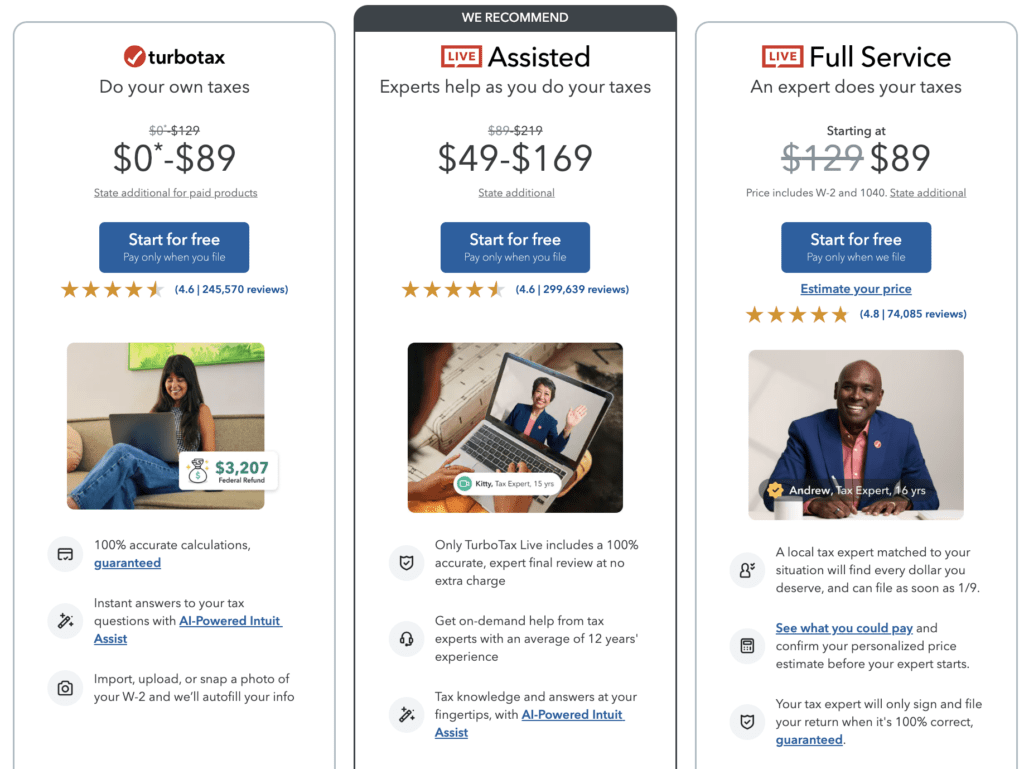

TurboTax has several plans to choose from, each with a different cost:

- Do your own taxes: $0 – final price of $89 – If you have a simple tax return, this is the program for you. It will walk you through all possible tax deductions and credits and even help you calculate your charitable deductions.

- Live Assisted: $49 – final price of $169– This option allows you to have experts to help along the way as you do your taxes.

- Full Service (LIVE): Starting at $89 – This option allows you to have an expert who will do your taxes for you.

File Your Taxes with Ease from Home Today with TurboTax!

Detailed Cost Comparison: CPA vs TurboTax

When deciding between TurboTax and a CPA, cost is often a significant factor. As you can see, TurboTax offers several pricing tiers, ranging from $0 to $170+, depending on the complexity of your tax situation and the level of support you require.

Additional costs may apply for state tax filing and other add-ons.

On the other hand, hiring a CPA can be more expensive, with average fees around $350 for preparing an itemized 1040 and a state return.

However, CPAs provide personalized advice and can be invaluable for complex tax situations.

How Hard is it to do your own Taxes?

Preparing your own taxes without a tax preparation software is difficult unless you know what you’re doing. But, with tax software programs, like TurboTax, it can be easy.

If you can read and follow the prompts throughout the program, you can file your own taxes. Especially if you have a simple tax return and nothing too complicated.

If you’re unsure about certain income or whether or not something qualifies you for a deduction, you may want help, but even TurboTax provides assistance (typically included) from a live CPA.

Get your FREE Tax Refund Estimator TODAY!

Audit Protection and Support

TurboTax offers a unique feature called Audit Defense, which provides users with professional representation in the event of an IRS audit.

For an additional fee, TurboTax will handle all correspondence with the IRS, develop a plan of action, and represent you in meetings.

This service can offer peace of mind for those concerned about potential audits.

Key Differences Between TurboTax and a CPA

You may wonder why anyone would use a CPA when TurboTax and other tax software programs offer step-by-step instructions to file your taxes.

There is one key difference – tax planning. TurboTax can ensure you are following all tax laws, but it doesn’t help as far as tax planning.

If you’re an investor, business owner, or have other complicated tax situations, you may benefit from the assistance a CPA could provide.

Not only would he/she help you file your taxes, but they would also help you plan for future years, especially if you overpaid in taxes this year.

Tax Planning vs. Tax Compliance

It’s important to distinguish between tax planning and tax compliance. Tax compliance involves preparing and filing your tax return, which is where TurboTax excels.

However, tax planning is about making strategic decisions to minimize your tax liability in the future.

This is where a CPA can provide significant value, offering personalized advice and strategies tailored to your financial situation.

Save Money (even on a tight budget) with This ULTIMATE SAVINGS GUIDE!

8 Easy Tips for Filing Taxes This Year

- Keep careful documentation of all income, expenses, and potential deductions

- If you run a business, keep your personal income and business income separate

- Thoroughly cover all available tax deductions and credits and if you’re unsure ask a professional

- Make sure you report all income, no matter how small

- Consider contributing to a pre-tax retirement account to lower your tax liability

- File your taxes on time

- If you can’t pay the full liability, work out a payment arrangement with the IRS right away

- Pay your estimated quarterly taxes if you’re self-employed

Remember: Keep track of your expenses and income on a spreadsheet or bookkeeping program such as FreshBooks.

My Final Thoughts

When looking at TurboTax vs a CPA, it’s a big decision. But, if you use a CPA to handle your finances outside of your taxes, it’s a no-brainer.

Consistency is key and who better to handle your taxes than the person who already handles your finances?

If you’re a DIY person, though, TurboTax is a great platform to use. It makes filing your taxes simple, almost as if you know what you’re doing.

Honestly, though, if you have the necessary documentation and are confident in the information you have, filing your own taxes isn’t as hard as it seems.

If you’re ever in doubt though, there’s always a professional CPA ready and willing to help. You can also setup a call with me to see if you’d like to have your taxes professionally done by my team.

Good luck this year from myself and The Handy Tax Guy Team!

If you enjoyed this article, then you’ll love these:

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

Photos Courtesy of Canva.com!

(Original Article Date: December 13, 2021/Updated on January 9, 2025)