Trying to figure out how to file quarterly taxes can be tough. I get it!

Being your own boss has amazing perks. You set your own hours, create your own rules, and the sky is the limit in how much you earn. But, there’s a downside – you’re also responsible for paying your own taxes.

Since you don’t work for an employer who would take your taxes out of each paycheck, you must send your tax payments to the IRS yourself, quarterly.

It’s a big responsibility, but once you get the hang of paying quarterly taxes, it becomes just another business chore you must handle.

Here’s what you must know.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

Do I Have to File Quarterly Taxes?

If you work for yourself as a freelancer or you own your own business, you likely have to pay quarterly taxes. The IRS has a pay-as-you-earn tax rule, meaning you pay taxes as you earn them.

Since you work for yourself, you don’t have an employer collecting the taxes for you, so instead, you must file your tax payments quarterly.

If you don’t trust yourself to pay quarterly, you can pay monthly or even weekly, especially if you pay online. The key is to have your tax payments in on time so you avoid any unnecessary penalties.

Who Pays Quarterly Taxes?

Anyone who doesn’t work for someone else typically has to pay quarterly taxes, but here’s a quick rundown of who might have to pay them:

- Sole proprietor running his/her own business

- A freelancer running a side gig business

- Freelancer running a full-time business

- Anyone working in a partnership

- A business owner running an LLC

You are only exempt from quarterly taxes if you expect your tax liability to be less than $1,000 or you didn’t have a tax liability last year.

How do I Determine how Much I Owe in Quarterly Taxes?

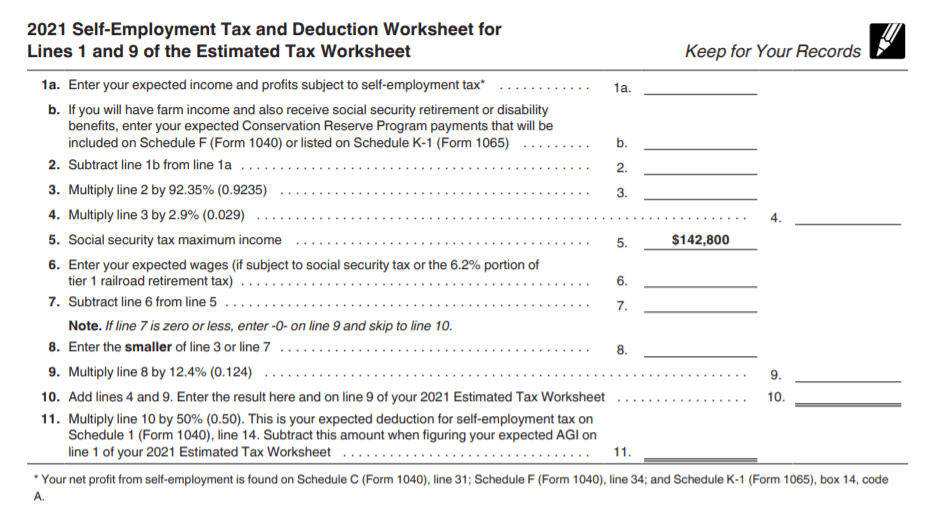

To determine how much you owe in quarterly taxes, complete IRS Form 1040-ES. This differs slightly from Form 1040 because the ES stands for estimated. When you pay your taxes quarterly, you’re estimating your tax liability to the best of your ability.

If you owned the same business last year and think you’re on track to earn the same amount, you can use last year’s Adjusted Gross Income (AGI). If you think your income will be different this year (higher or lower), you can adjust as you see fit.

You can complete Form 1040-ES manually or use an online tax software – whatever you are more comfortable using.

Which online tax services are the best?

On Form 1040-ES, you’ll determine your deduction for self-employment tax, the qualified business income deduction, and your tax rate.

The form helps you determine your total tax liability for the year – you then divide the amount by 4 and pay that amount each quarter.

How much Should I set Aside for Quarterly Taxes?

Since freelancers and business owners pay both sides of the Social Security and Medicare tax (15.3%) plus income tax on their profits, your best bet is to save 25% – 30% of your income for taxes.

But, if you have a large number of expenses and you can estimate them when running your 1040-ES, you can deduct that amount from your projected income to lower the amount you save.

More Tax Savings: File at Ease at Home with Turbo Tax

How do I File Quarterly Taxes?

You’ll need IRS Form 1040-ES to file quarterly taxes. Send your completed form and payment to the appropriate address. You can also pay your taxes online.

It’s important to file and pay your quarterly taxes. If you don’t and you owe more than $1,000 at tax time, the IRS will hit you with an underpayment penalty.

The IRS assesses the underpayment penalty if you don’t file your estimated taxes quarterly and if you don’t pay enough estimated taxes for the year. If your income increases and you think you didn’t estimate your taxes high enough, make sure to adjust throughout the year to avoid the penalty.

Example Scenario

Stephen is self-employed and has been for a few years. Last year Stephen owed the IRS $8,000 in taxes. He can assume the same liability this year and make $2,000 payments each quarter to be on the safe side. Even if Stephan is off a bit, he won’t owe a penalty because he paid 100% of his tax liability from the year before. If Stephan knows his income increased significantly this year, though, he should adjust his payments accordingly. He could even send in a large payment at any point in the year if he thinks he’s behind in payments or will owe more as long as he made his quarterly payments on time.

6 Pro Tips to Remember When Filing Your Quarterly Taxes

- Estimated taxes are due quarterly on April 15, June 15, September 15, and January 15

- You can avoid penalties if you pay at least 100% of your tax liability from the previous year

- You can also avoid penalties if you pay at least 90% of your tax liability for the current tax year

- Set money aside regularly to cover your taxes, whether you take a portion of each payment you bring in or you make it a monthly ‘bill’ to pay each month

- You can pay your estimated taxes whenever you have the money, even if it’s early, just don’t file late

- You may still owe taxes when you file your tax return, but you can pay the difference at tax time

Remember: Keep track of your expenses and income on a spreadsheet or bookkeeping program such as FreshBooks.

Final Thoughts

Don’t skip your quarterly tax payments if you’re self-employed or own a business. The large tax liability will hit you hard come tax time and the underpayment penalty is an unnecessary expense.

While the IRS requests you to pay your tax quarterly, you can pay them more frequently if that’s easier for you. The key is to have your liability paid before the due dates mentioned above.

At the very least, pay as much as you owed last year and adjust your payments accordingly if you know your income increased or your expenses decreased from the previous year.

If you enjoyed this article, then you’ll love these:

- Your Ultimate Guide to Etsy Taxes and Tips for Shop Owners

- 25 REAL Ways to Make Money from Home for Busy Professional Moms

- Tax Deductions (You’re Missing) and Tips for Bloggers and Online Influencers

- Do I Need to File IRS Form 8832 for My Business?

- Is Your Side-Hustle a Hobby or Business for Taxes?

Until the next money adventure, take care from The Handy Tax Guy Team!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**