Are you trying to figure out if you will receive the Child Care Tax Credit this year?

As you may know, the government allows for certain tax advantages if you have a child under the age of 18. Recently the government started distributing monthly advance payments of these credits in July through the Advance Child Care Tax Credit Payments.

Let’s go through everything you need to know about the current rules surrounding this updated program, if you qualify and if you should take advantage of this credit.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

What are Child Care Tax Credits?

Child Care Tax Credits are tax credits given to parents of children who are under the age of 18. For the 2021 tax year, the current Child Care Tax Credit is $3,000 for every child under the age of 18 and over the age of 6 as of December 31, 2021.

Any child that is under the age of 6 on December 31, 2021 entitles the parent to a $3,600 tax credit. These tax credit are eligible for single filers making under $75,000 per year, joint filers making under $150,000 and $112,000 for head of household filers.

Please Note: A tax credit a great break for you because can lower your tax bill (dollar-for-dollar). So in essence, if your tax advisor can get your tax bill as low as possible (maybe even at zero) you may end up getting a tax refund as you’d get whatever’s left.

How Do Child Care Tax Credits Work?

In the past, the Child Care Tax Credits were paid in full after a tax return was filed with the IRS. With the passage of the American Rescue Plan Act, the Child Care Tax Credits are now paid in advance of a tax filing return on a monthly basis.

The first of these payments were paid out in July of 2021.

What’s New with the Child Care Tax Credits?

From the start July of 2021, the Child Care Tax Credits will be paid out in six monthly payments. These payments will continue until the end of the year.

Also, the Child Care Tax Credits have increased for those with children under the age of six on December 31, 2021. Child Care Tax Credits for children under the age of six will now receive $3,600 instead of $3,000.

How Do You Qualify for Child Care Tax Credits?

In order to qualify for Child Care Tax Credits, you will have to meet the following criteria:

- You are responsible for at least half of the child’s financial support.

- Your child is under the age of 18 as of December 31, 2021.

- The child cannot file a joint tax return.

Check to see if you’re eligible here.

How Much is the Child Care Tax Credits ?

Currently, the Child Care Tax Credit is $3,000 for every child between the age of 6 and 17 and $3,600 for every child under the age of 6 as of December 31, 2021.

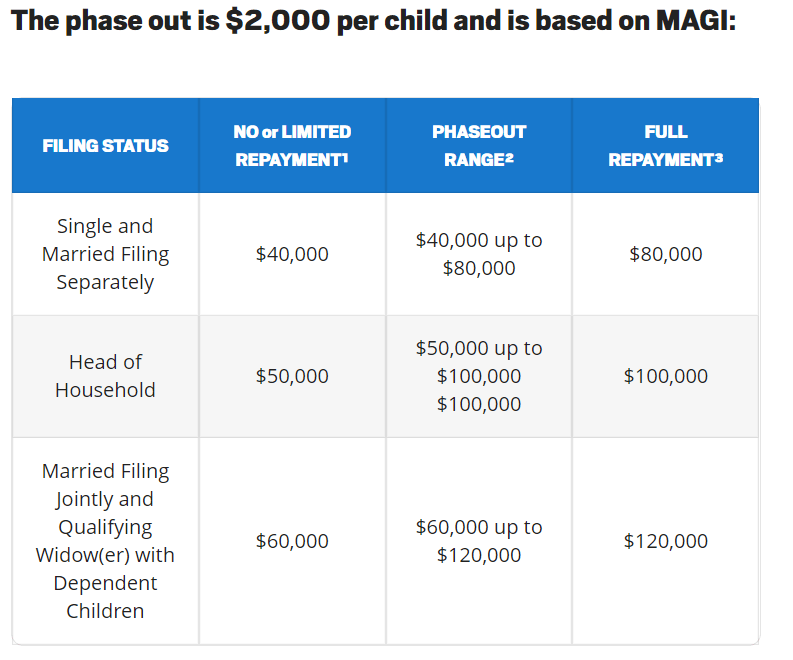

When will the Child Care Tax Credits Phase Out?

The tax break begins to phase out in 2021 (meaning the extra $1,000 or $1,600) for taxpayers who:

- File jointly with a modified Adjusted Gross Income (AGI) of $150,000+

- Will file head-of-household filers with a modified AGI of $112,500+

- File Single (or any other filing status) with a modified AGI of $75,000+

The rules for a 2020 tax return had the child tax credit at $2,000 per child under the age of 17 that was claimed as a dependent on your tax return.

The credit would begin to “phase out” if your modified adjusted gross income (AGI) was more than:

- $400,000 on a joint return

- $200,000 on a single or head-of-household return

So, if you were over the $400,000 or $200,000 modified AGI threshold, your credit amount would’ve been reduced by $50 for each $1,000 of your AGI over the phase-out threshold.

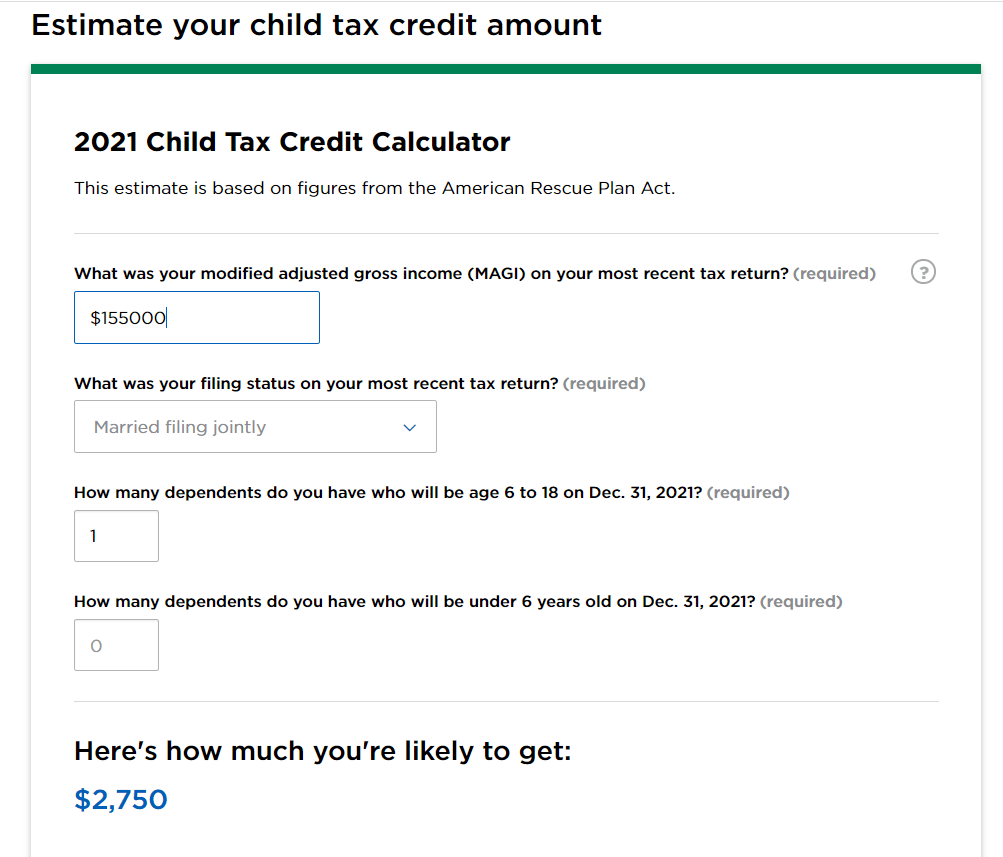

Example Scenario

The Porter family has only one child who is nine years old. They file a joint return that ends up showing a modified AGI of $155,000 for 2021. Since their AGI (Adjusted Gross Income) is $5,000 above the phase-out limit, they won’t get the full $3,600 tax credit. They’ll instead get a $2750 reduce tax credit.

How do the Child Care Tax Credits Monthly Payments Work?

The monthly Child Care Tax Credit payments will begin in July of 2021. The payments are expected to go out via Direct Deposit, debit card, or paper checks on the 15th of each month of August, September, October, November, and December, another payment is expected.

The final payment will be made on December 15, 2021.

When Will I receive my Advance Child Care Tax Credit Payment in 2021?

- July 15

- August 13

- September 15

- October 15

- November 15

- December 15

There is also an option to receive 100% of the Child Care Tax Credit payment at the end of the year. In order to get a full payment at the end of the year, you will have to opt out of the monthly plan on the IRS’ Child Care Tax portal.

Pros and Cons of Getting the Monthly Payments?

The monthly payments for the Child Care Tax Credit plan is designed to make it easier for you to get access to money as the country recovers from the 2020 global crisis. Here’s a look at the overall pros and the cons of getting monthly payments.

Pros

- Quicker access to money – Instead of getting one lump payment, you will not get six payments earlier than usual. This will help when it comes to handling more immediate expenses.

- Helps people adversely affected by 2020 – If you have been immediately impacted by the pandemic, then the monthly payments will allow you to get the money that you need to handle any bills or expenses that may have piled up.

Cons

- No lump payment in the spring of 2021 – Some people count on the large lump sum payments that come in the Spring. With the monthly payments arriving early, there will be such big payments in the Spring of 2022.

- May make it harder for major purchases – Some families will use the lump sum payment from Child Care Tax Credits to play for major purchases such as a vehicle or a down payment for a home. With monthly payments, it may be harder to save up.

What if I haven’t Received My Monthly Payments Yet?

If you have not received your first monthly payment by July 15, then you may not want to panic just yet. However, if you are receiving a paper check, then you will want to wait at least 10 business days after July 15 before contacting the IRS.

If you are anticipating your monthly payments by Direct Deposit or via a debit card, then you may have to wait one or two business days. The IRS is rarely late with Direct Deposit or debit card payments.

However, your bank may experience a delay when it comes to processing and posting the deposit into your account.

More Tax Savings: File at Ease at Home with Turbo Tax

Why haven’t I received the child tax credit?

There are a few additional situations you may want to look into such as:

- Did you file your 2020 tax return?

- Were you affected by the IRS glitch for families with an immigrant spouse?

- Are you getting a paper check?

- Was your banking information up-to-date on your last tax return?

If none of these apply to you, then you can see what’s holding up your payment here.

However, if you know your payment has been sent, but you haven’t received it, then you can request a Payment Trace to track your payment.

The IRS will not be able to trace your payment unless it has been:

- 5 days since the deposit date and the bank says it hasn’t received the payment

- 4 weeks since the payment was mailed by check to a standard address

- 6 weeks since the payment was mailed, and you have a forwarding address on file with the local post office

- 9 weeks since the payment was mailed, and you have a foreign address

To start a payment trace, mail or fax a completed Form 3911, Taxpayer Statement Regarding Refund.

4 Top Child Tax Credit Tips to Remember

Here are some top tips to remember when it comes to Child Care Tax Credits:

- The monthly payments are expected to be paid on the 15th of each month from July until December

- IRS will use your most recent tax return to see if you qualify for the Child Tax Care Credit.

- If you have not filed a tax return recently, then you should do so to prevent a delay in your Child Tax Care Credit payment.

- However, if you are a low-income family, then you can use the IRS’ non-filers sign-up tool to register for the advance monthly payments.

Get your biggest tax refund guaranteed with TurboTax. The #1 best selling tax software. Start today.

Final Thoughts

This year, the Child Care Tax Credits are coming easily in the form of monthly advance payments. Make sure you understand how much money you may receive each month. If you have not received your July monthly payment by August, then be sure to contact the IRS right away.

I hope this article helped you gain some control of your tax plan this year. Remember not to stress out. Don’t forget to check out Tax Forms page for any additional online tax checklists and forms you may need this year.

If you like this article, then you’ll love these:

- CAUTION: What to Do if You’re a Victim of Tax Identity Theft

- Everything You Need to Know about Injured Spouse Tax Relief (IRS Form 8379)

- IRS Form 8822: How to Change Your Address with the IRS the RIGHT WAY!

- Tax Software vs. Accountant or Tax Pro: Should I Do My Own Taxes?

- IRS Form 8332: How Can I Claim a Child?

Until the next money adventure, take care from The Handy Tax Guy Team!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**