The IRS needs a current address to send you any refunds and correspondence. It can take up to 6 weeks to process a change of address. Most people use IRS Form 8822 to change their address, but there are a couple of other methods too.

If you move after you file your taxes, you’ll need to complete the IRS form. If you move before you file your taxes, your new tax returns will reflect the new address, but you must take other precautions too.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

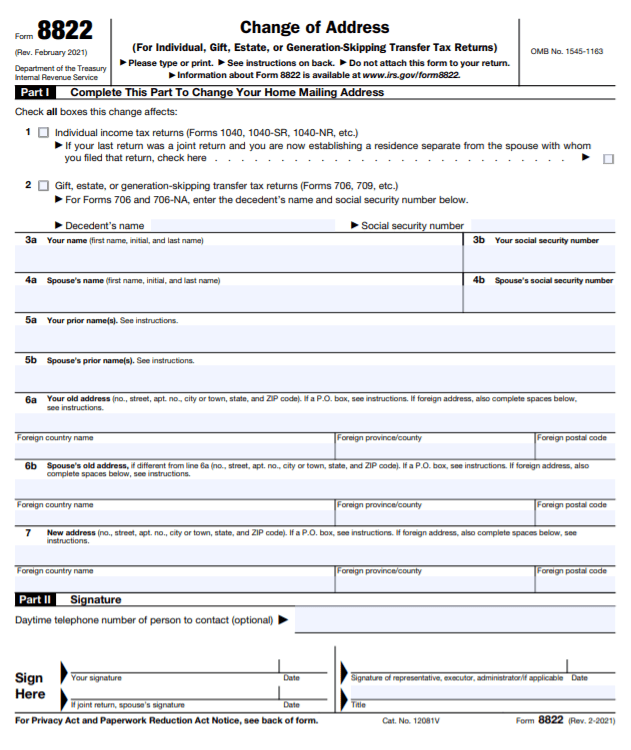

What’s is the IRS Form 8822?

IRS Form 8822 is the most secure and accurate way to change your address with the IRS. The change of address form is easy to complete. Your name (and spouse’s name), old address, and new address are all you need.

You’ll also need to note the tax returns your change of address effects. Is it:

- Individual income tax returns

- Gift, estate, or generation-skipping tax returns

Note: If you’re changing your address for a self-employed business, you must file IRS Form 8822-B.

Send your change of address form to the IRS address that corresponds to your old address. This is the IRS office you sent your tax returns to when you lived there. The old IRS office will notify the new IRS office of your new ‘tax home.’

Anyone with a change of address should consider completing the form unless you’ve filed your taxes with your new address. Even if you think the IRS has no reason to contact you, change it.

None of us expected stimulus checks prior to last year, right? You wouldn’t want to be caught with the wrong address on file, forcing you to wait for your money.

File Your Taxes with Ease from Home Today with TurboTax!

Example Scenario for IRS Form 8822

John moved from Illinois to California on April 30, 2020. He already filed his taxes (even with the extended tax deadline). He had to tell the IRS of his change of address for correspondence and the IRS stimulus check.

John downloaded IRS Form 8822 from the IRS website and completed the following information:

- He checked the box for Individual tax return

- Entered his name and Social Security Number

- Entered his wife’s name and Social Security Number

- Provided his old address in Illinois

- Provided his new address in California

- He signed the form

Since John moved FROM Illinois, he sent the form to the IRS address dedicated to residents of Illinois (and many other states). This is different from the IRS address for California residents, but John was changing his address from the Illinois branch, which had his current information.

What to Know About IRS Form 8822

Let’s go over a few of the most commonly asked questions that you may have about this tax form.

Can you change your address with IRS online?

Unfortunately, the IRS doesn’t offer an option to file IRS Form 8822 online, but you have many other options.

There’s one exception. If your refund check didn’t get forwarded to your new address, it may have been returned to the IRS. On the IRS website, click ‘Where’s my Refund’ and you’ll be prompted to enter your new address.

Where do I send Form 8822 to the IRS?

On the first page of IRS Form 8822, the IRS tells you where to send the form. It’s based on where you’re moving FROM not to.

Can I change my address with the IRS over the phone?

If an IRS employee contacts you, they can change your address if you provide verbal verification of the new address.

Can the post office change your address?

You can change your address with the post office (and should for many reasons), but don’t rely on that alone. If you have correspondence or a refund check on its way soon, there’s no guarantee it will reach your new address.

Cover your bases and change your address with the post office AND the IRS.

Does changing your address on your tax return officially change it with the IRS?

Yes, if you haven’t changed your address with the IRS yet, filing your tax returns with the new address will change it.

Will your refund check be forwarded to your new address?

No, the IRS doesn’t forward checks. The post office will send it back to the IRS, which is why IRS Form 8822 is so important.

5 Easy Tips for Changing Your Address with the IRS

1. If you don’t have access to IRS Form 8822, you can send written notice of your address change.

Mail the letter to the same address you send your completed tax returns.

Make sure you include the following information:

- Both your name and your spouse’s name (if applicable)

- Your complete old address

- Your complete new address

- Social Security numbers for all parties

- Signatures of all parties

2. If you make estimated payments, don’t cross out the old address on your vouchers.

Instead, complete IRS Form 8822 and keep using the old vouchers until the IRS processes your form and sends you new vouchers.

3. If you can’t access the form online, call 1-800-TAX-FORM or visit your local IRS office (if they’re open).

4. If you’re married and filing joint, you only need one IRS Form 8822 to change both addresses.

5. If you don’t change your address with the IRS, they don’t have to give you extra time to pay taxes due or respond to a correspondence sent to your old address.

So, change your address as soon as possible with the IRS.

More Tax Savings: File at Ease at Home with Turbo Tax

Bottom Line

If you move, complete IRS Form 8822 when you change your address at the post office. Both are equally important and ensure all IRS correspondence or refunds make it to you.

If you don’t use any of your options before you file your tax returns, your address will change with the new filing, but it’s best not to wait.

I hope this article helped you gain some control of your tax plan this year. Remember not to stress out. Don’t forget to check out Tax Forms page for any additional online tax checklists and forms you may need this year.

If you like this article, then you’ll love these:

- How to Save Money for Vacation in 3 Months (23+ Money Saving Tips)

- Do I Need to File a Tax Return?

- Pay Off Debt Quickly with These 4 Simple Tips

- How to Save $3,000 in 6 Months (Save Money Fast)

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**