Are you having a hard time trying to figure out how to pay off debt quickly this year?

Trust me, I get it!

Living in a country that is driven largely by consumerism can make it difficult for you to stay away from credit cards and all the other tempting debt.

On top of that, using credit cards and obtaining loans is a painless process, which makes it easier to spend money that may not be available.

Or money that you can’t pay back.

Once debt is accumulated it can be difficult to get rid of it, but it is certainly far from impossible.

This topic is dear to me as I was in $500,000 worth of debt! That’s why I want to show you the plan that I did to help you get out debt quickly.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

How to Pay Off Debt Fast in 5 Easy Steps

First off, paying off debt takes a slow and methodical approach. Let’s not forget the fact that the average American carries a debt balance of $96,371, while the average salary is around $55,800.

This provides context for the financial challenges many face. Now let’s jump into the ways of how you can begin eliminating debt in an easy and quick way!

1. Create a Budget

First and foremost, having a proper budget in place is critical to getting out of debt quickly.

Without a budget, you lack a plan and purpose for your money. This leaves the door open for unnecessary spending that puts you much deeper into debt.

With your budget, you’ll want to ensure all unnecessary spending is eliminated and from there, those funds are all directed aggressively to eliminating debt.

By creating a budget, you are directing where your money is going.

However, you don’t have to eliminate all enjoyable purchases such as eating out or entertainment.

But, if you want to become debt free you must curb those expenses for the time being in order to create the life you deserve!

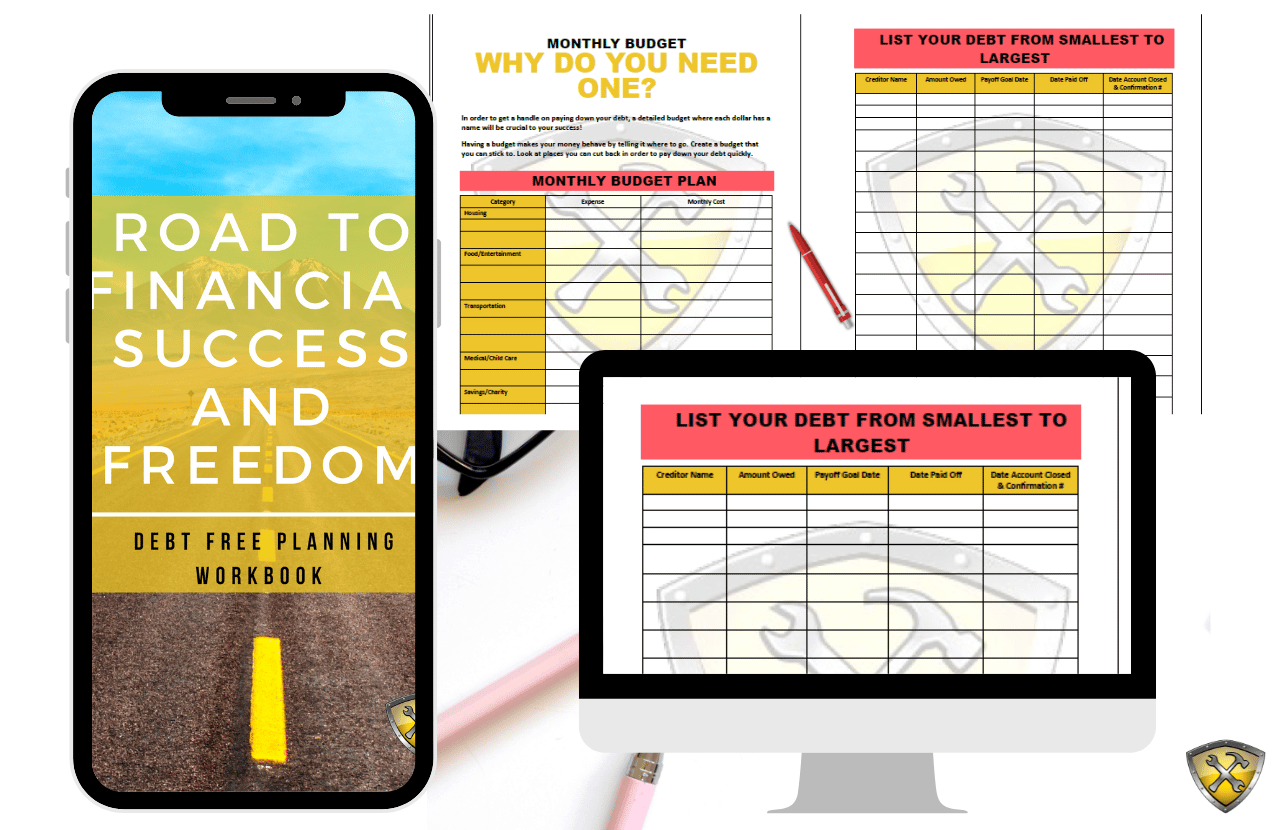

Get out of Debt TODAY with the ULTIMATE DEBT FREE WORKBOOK!

2. Use a Debt Elimination Plan

Once you’ve created a budget, you’ll want to implement a debt elimination plan. This plan will give you guidance on prioritizing your debt and begin eliminating your balances one by one.

The first plan that is among the most popular is the debt avalanche.

This method takes all of your debts and puts them in order from highest interest rate to lowest.

By doing this you save money on interest payments in the long run. However, you may have your largest balance as the first debt and this can take time to pay off.

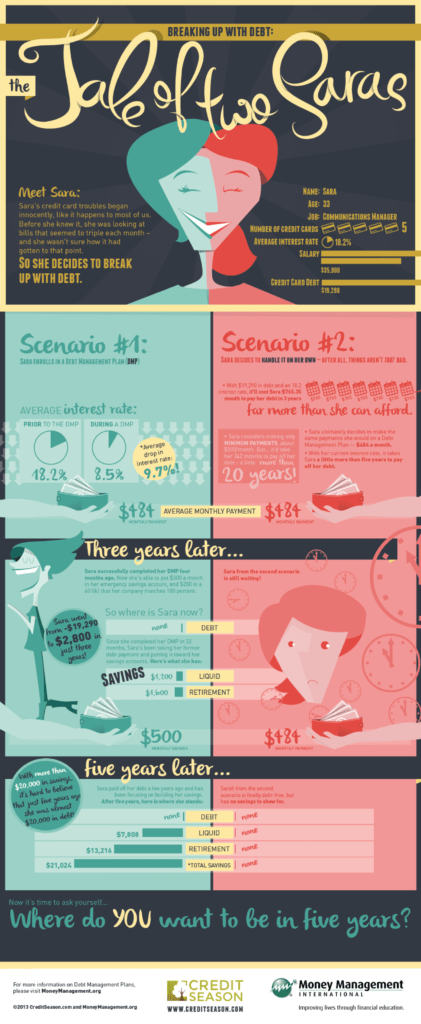

3. Use the Debt Snowball Method

The second plan to consider works in a similar manner and is called the debt snowball. It’s what I used to get out of debt and it gave me so much hope!

This method takes all of your debt and puts them in order from smallest to largest by balance size.

I also sold my 5-bedroom house during this process and moved into a 2-bedroom apartment to help take off the biggest debt that I had (my mortgage).

Just know that I was living alone at the time so I didn’t need that much space and I was DETERMINED to get out of debt!.

Using this method gives you the ability to see tangible results quickly! This in turn will fuel your momentum and cause you to get out debt fast, even with a low income.

Keep in mind that this method may result in more interest payments.

I also recommend avoiding new debt while paying off existing debt. This is crucial to prevent the debt from growing and to ensure that efforts to pay off debt are not undermined.

Regardless of your decision, the main goal is to reduce or eliminate your debt quickly. Finding what works best for you is key and as long as you stick with it that’s all that matters.

4. Increase Cash Flow

Lastly, to pay off debt quickly you should look into increasing you cash flow.

By doing this, you can allocate more dollars to your debt, which will lead you to financial freedom quickly.

In order to increase your incoming cash flow, you’ll need to either pick up a second job or freelance on the side.

Popular freelancing websites are Fiverr.com and Upwork.com, which allows you to market your own talents and make lots of extra cash on the side.

And believe me, you have something special that you do to make extra money on Fiver.com.

If you are looking to sell products, you can use websites such as Etsy or eBay. You can even create your own blog that focuses on your family travels like I did!

Lastly, delivering food for Uber or Door Dash or working for a ride sharing service are also good ways to increase incoming cash flow.

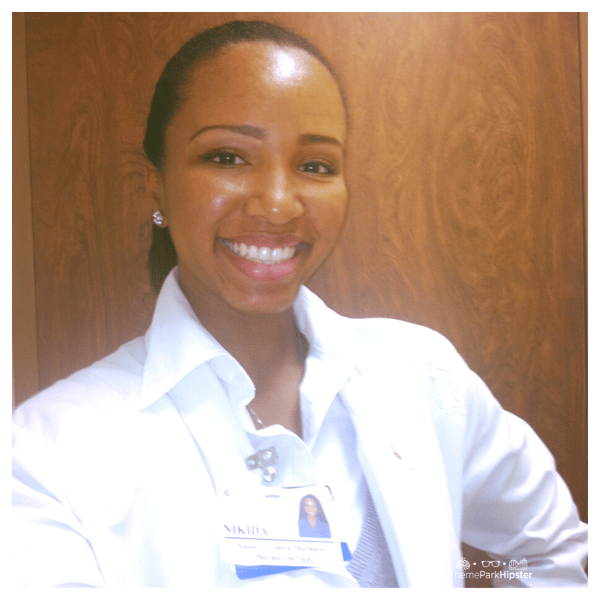

Recommended: How Our Co-founder, Nikida, Grew Her Blog From 0 to $10K+ a Month

5. Credit Counseling

Credit counseling can be a helpful resource for those struggling to manage their debt.

Nonprofit credit counselors offer services that include budgeting assistance and debt management plans.

They can negotiate with creditors to reduce interest rates or waive fees, making it easier to pay off debt.

However, I strongly recommend that you seek a reputable credit counseling agency to explore these options.

Get out of Debt TODAY with the ULTIMATE DEBT FREE WORKBOOK!

15 Creative Ways to Help Pay off Debt

Now that we know how to pay off debt quickly, let’s talk about things you can do today to help you save more money to put towards your debt.

- Set your budget up the right away

- Open up a bank account that’s only dedicated to saving for your vacation

- Set up an automatic transfer to your savings bank account (do weekly or bi-weekly transfers)

- Start using cash to pay for your daily expenses (think of the envelope system that Dave Ramsey speaks about and only budget a certain amount of money for day-to-day items…once it’s gone you have to wait for the next month to take more cash out)

- Take a break from buying coffee (instead make your own coffee at home)

- Keep your monthly food budget in check

- Become a meal planning pro

- Find gym alternatives to save money (work out from home or ask for deals at your current gym)

- Eat out less

- Remove big expenses from your budget like your outrageous rent/mortgage car (I know I’m being blasphemous right now, but could you sell your car and buy a cheaper car?)

- Get a part-time job

- Car pool to work with your co-workers (you guys can alternate the weeks of who will drive into the office or location)

- Download a savings app

- Rent out a room in your home

- Stay motivated while saving

File Your Taxes with Ease from Home Today with TurboTax!

My Final Thoughts to Help You Pay Off Debt Quickly

Eliminating your debt fast will not only free up your cash flow, but it will allow your investments to grow without hindrance.

If you have an investment that earns 6% but your debt is costing 10%, it ends up being a net loss in the end.

The key to paying off debt quickly is to first establish a budget and begin directing your money where to go.

Secondly, is to implement a debt elimination plan that fits your current lifestyle.

Lastly, increase your cash flow by starting a freelance business or selling unwanted items. The quicker you are able to eliminate debt the quicker you can begin building wealth!

I hope this breakdown helps you discover some additional ways of how to get out of debt quickly. Let me know which tip is your favorite in the comment section below.

If you want more handy tax tips, then feel free to check out my latest articles here. For more money-saving tips and guides, subscribe to the weekly newsletter!

If you enjoyed this article, then you’ll love these:

- 5 Simple Money Saving Tips

- How to Get Out of Debt on Dave Ramsey Plan

- Easy Ways to Make Money from Home

Until the next money adventure, take care!

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: February 18, 2019/Updated On December 14, 2024)