Are you a divorced family, wondering how you’ll handle taxes when claiming your dependents? The IRS law makes it pretty clear cut who gets to claim them – the custodial parent. But, if you want to relinquish those rights, you can with IRS Form 8332.

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. This means if you click on any of the links, I’ll receive a small commission.

Understanding the IRS Form 8332?

Normally the parent with full-custody (where the child spends most of his/her nights) claims the child on their tax returns. This is the custodial parent.

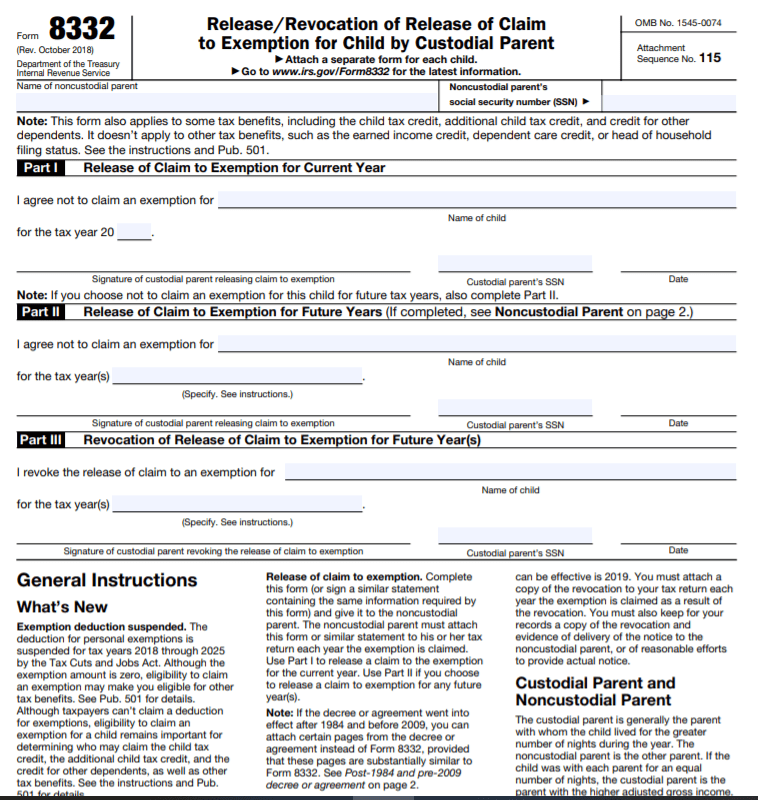

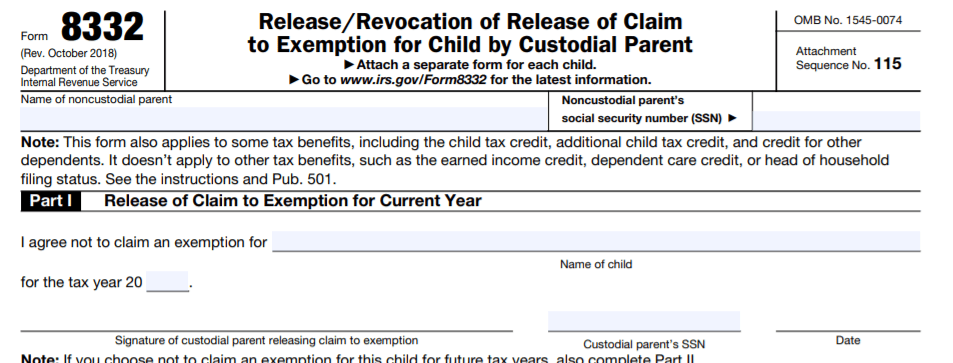

If you don’t file taxes or it makes more sense for your ex-spouse to claim the child(ren), you may do so with IRS Form 8332 – Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent.

Please keep in mind that the tax exemption benefit for dependents is still $0 until 2025, but you can take advantage in other forms such as:

- Child tax credit

- Tax credit for any other dependents

Read: Top 12 Things You Must Know About the New Tax Laws

How Do You Use Form 8332?

If releasing the right to claim your child as a dependent makes financial sense, you must complete Form 8332 to make it official, aka legal.

The form requires minimal information – it’s all information you’ll have handy. You sign the form to show your agreement to give your ex-spouse the right to claim your child as a dependent.

As the custodial parent, you complete the form and give it to your ex-spouse – not the IRS. When the non-custodial parent completes his/her tax returns, Form 8332 must accompany it.

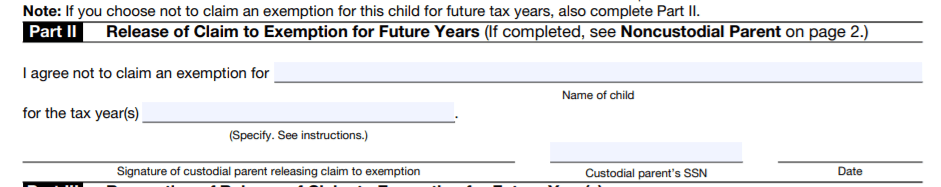

You may complete the form for a single tax year or multiple years. If you choose multiple years, skip Part 1 on the form and complete Part 2.

This gives the non-custodial parent the right to claim the child(ren) for as many years as noted on the form.

File Your Taxes with Ease from Home Today with TurboTax!

Example Scenario

Joe and Carrie were married for 10 years. In that time, they had 2 children. Since then Joe and Carrie divorced. Carrie has full-custody of the children, and by law has the default right to claim the children as dependents.

The law states as long as children receive ½ of their support from both parents, the custodial parent has the primary right to claim the children on their taxes. It doesn’t matter if the non-custodial parent provides more financial support, the parent with custody has default rights.

The custodial parent is the parent who the child lives with more than half of the time, which in this case is Carrie. But, since Carrie doesn’t work, she doesn’t file taxes. She agreed to let Joe use the children as dependents.

Carrie completes IRS Form 8332, giving Joe the right to claim the children for the next three years. Carrie doesn’t have to do anything else after completing the form. Joe must include the form with his taxes every year for the next three years.

What to Know about Form 8332

Now that we have the basics out of the way, let’s go through some of the most common questions to make your process easier.

Where do I mail IRS Form 8332?

The non-custodial parent or the parent claiming the child as a dependent must include Form 8332 with their Form 1040 each year.

What is IRS Form 8332?

The formal name is Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent. The form allows a non-custodial parent to claim a child or children on his/her tax returns.

How do I fill out IRS 8332?

Form IRS 8332 is simple. All you need is the non-custodial parent’s social security number, name of the child(ren), the chosen tax years, your signature, and social security number.

What happens if a non-custodial parent claims a child on tax returns?

If a non-custodial parent claims a child on tax returns without IRS Form 8332, the IRS may perform an audit. If they find you unlawfully claimed the child(ren), they may claim that you tried evading your tax liability.

What if a custodial parent will not sign Form 8332?

The IRS requires Form 8332 before a non-custodial parent can claim a child on their taxes. Without it, the dependent belongs to the custodial parent.

This is something that I cannot give you a straight answer to, as it will depend heavily on your relationship with the custodial parent.

Can you file for Form 8332 electronically?

If you e-file your tax returns, you may also e-file Form 8332.

Will I know if my ex-spouse claimed my children on his/her taxes?

If both you and your ex-spouse claimed your dependents on your tax returns, the IRS will issue Letter CP87A alerting you of the double claim. Make sure you follow the IRS requirements to resolve the issue.

File Your Taxes with Ease from Home Today with TurboTax!

5 Simple Tips to Remember When Claiming Your Child

- If you know you’ll release your right to claim children as dependents for multiple years, complete Part II of IRS Form 8332 for the years you’re sure of, to save yourself time and headaches.

- Form 8332 is only good for one year if you only complete Part I. If you are the non-custodial parent, make sure you obtain the executed form each year you claim the children as your dependents.

- Don’t take the dependent claims without Form 8332. The IRS can disallow any deductions or credits you took for previous years if you don’t have a legal allowance to claim the dependents.

- If you release your dependent claims to your ex-spouse, but later decide to take it back, complete Part III of Form 8332. You can claim it back for certain years or state ‘all future’ years if you want it back permanently. You may only do this the year following the year you provided Form 8332 though.

- The non-custodial parent must provide at least half of the child’s financial support to qualify. The child must also not live with anyone outside of you and your ex-spouse. If your situation doesn’t meet this criteria, Form 8332 doesn’t change your ex-spouse’s ability to claim the children as dependents.

Bottom Line

If you want to give dependency status to your ex-spouse, do it legally. Just stating that your ex can have the rights isn’t enough. The IRS wants official proof that you relinquished your rights by providing Form 8332.

Whether you give up dependency status for one tax year or multiple years, IRS Form 8332 takes care of giving your ex-spouse the deductions.

You can relinquish the right to claim dependency for future years at any time, but completing the form for multiple years also takes the burden off your shoulders.

For more money-saving tips and guides, subscribe to the weekly newsletter!

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- Tax Software vs. Accountant or Tax Pro (Which Should You Use?)

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- 11 Last Minute Tax Tips for Beginners

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Handy

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**