Your Virtual Income Tax Services Pro is Here!

This blog series is here to bring you up-to-date tax tips, news, and how to find the best online income ...

13 Proven Mileage Tax Deduction Tips

Don’t miss out on tax breaks you may need for your vehicle. The mileage tax deduction rate is one of the ...

Top 12 Things You Must Know About the New Tax Laws (Tax Reform Explained)

The changes to the new tax law may have you left with many unanswered questions. I want to make sure ...

Is Your Side-Hustle a Hobby or Business for Taxes?

Have you started your side-hustle or thinking about starting one? If so, it’s time to determine how to turn your ...

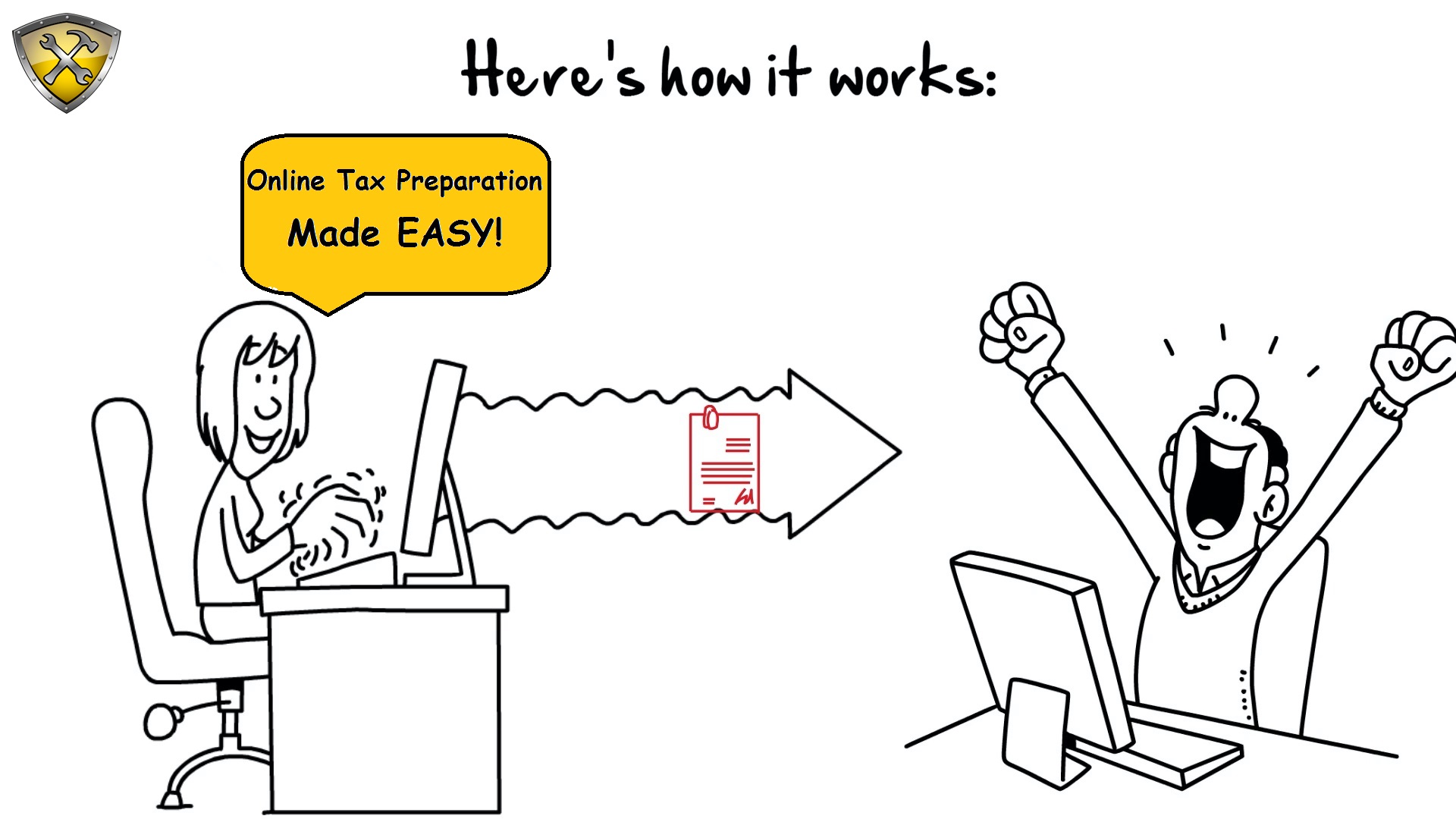

The Handy Tax Guy Does Taxes the Fun Way!

The Handy Tax Guy is here to give you a complete virtual tax service trouble-free with a human touch unlike ...