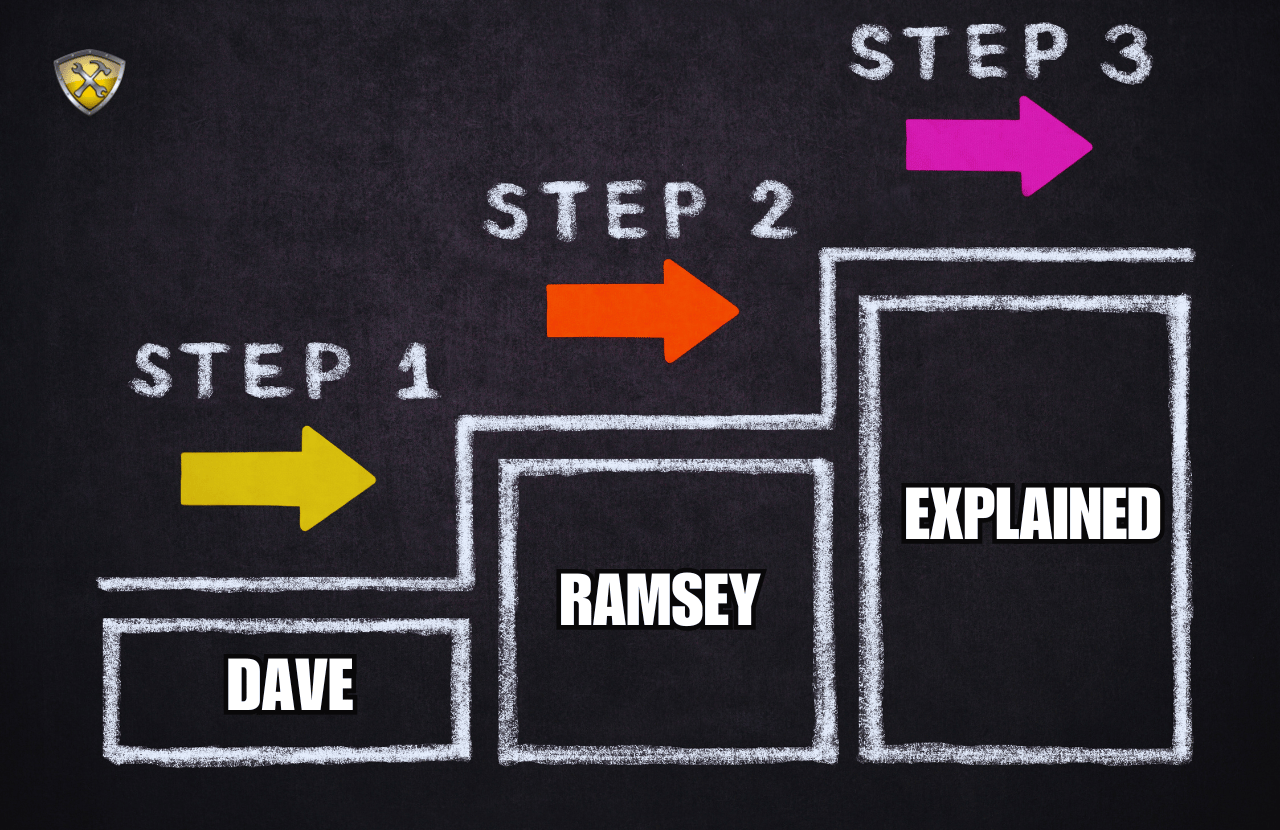

First-timer’s Guide to the Dave Ramsey Baby Steps Plan: Everything You Need to Know to Be Successful!

Have you ever wondered if the Dave Ramsey Plan could really work for you? Don’t worry, I was a skeptic ...

Maximize Your Money with Dave Ramsey’s Investment Calculator – Expert Tips Inside!

Are you trying to figure out if the Dave Ramsey Investment Calculator can help you truly plan out your retirement? ...

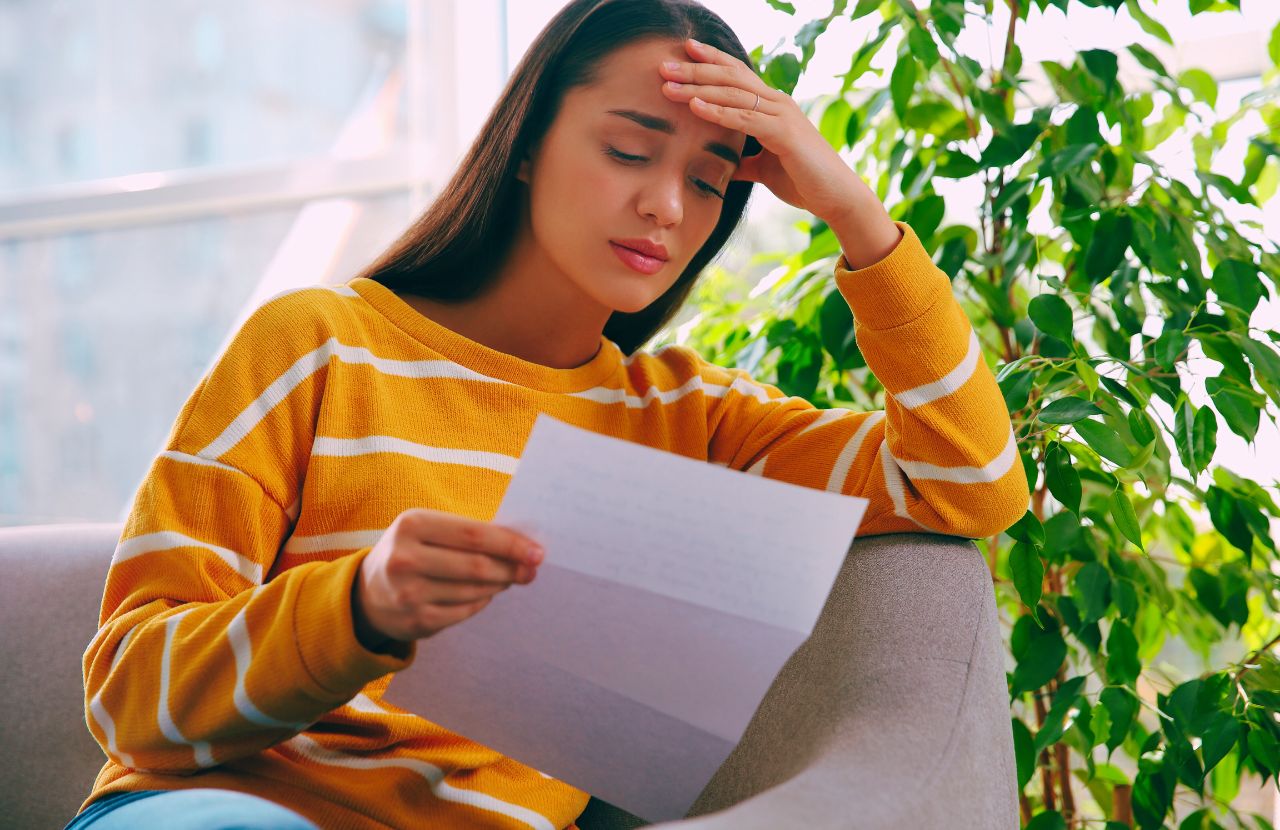

What to Do if You Receive the 4883c Letter from the IRS: Read this BEFORE you call!

If you received a 4883c letter from the IRS, it’s normal to feel panicked. What did you do wrong? What ...

2025 Complete Guide to the IRS 1098-T Form for College Students

As the new tax season approaches, you may have already started receiving multiple documents to hand over to your tax ...

What Are Tax Exemptions? Everything You Need to Know

You may be wondering, what are Tax Exemptions? Before 2018, Tax exemptions were a monetary amount given to help reduce ...