Do you know how to claim your cash tips on your tax return?

You may not know it, but all tips received are income and subject to federal income tax?

This includes tips:

- Received directly

- Charged tips paid by employer

- Shared tips received under a tip splitting or tip pooling arrangement

- The value of non-cash tips, such as tickets, passes, or other items

THIS POST MAY CONTAIN AFFILIATE LINKS. PLEASE READ MY DISCLOSURE FOR MORE INFO. Which means if you click on any of the links, I’ll receive a small commission at no additional cost to you.

Let’s answer one the most common questions that I’m always asked first.

Do I have to Report Cash Tips on My Taxes?

If you do receive any cash tips at your job, then the IRS requires you to report them no matter where the tips come from (employer, co-workers, customer, etc.).

You also have to report any non-cash items (gifts) given to you at your job at the value of the gift as taxable income.

How to Claim Tips on Your Tax Return

Now that we have that top question out-of-the-way, let’s go through how to claim the tips you make at your job on your tax return.

Step 1. Keep Records of Your Tips

If you receive tips, then you should keep a daily record. If you’re using an electronic system provided by your employer to track your daily tips, you should get a paper copy of those records.

It’s important to keep a good record in order to accurately report tips on your tax return and prove tip income

Use a good record to track the following on the daily basis:

- Cash tips received from customers or from other employees

- Tips from credit or debit cards paid to you by your employer

- The value of any non-cash tips received, such as tickets, passes, or other items of value

- The amount of tips paid out to other employees through pools, splitting, or other arrangements

Step 2. Know How to Report Tips to Your Employer

When it’s time to report your tips, use IRS form 4070. If your employer does not have a process of reporting your tip income, then tip reports must be submitted to the employer by the 10th of the next month.

Step 3. Know When to Report Tips to Your Employer:

- Report only cash, check, debit cards, and credit card tips received

- For tip splitting or pool arrangements, report only tips received and retained

- All tips received from other employees must be reported

- It’s not necessary to report the value of non-cash tips tickets or passes to the employer

- Total tips for any one month from one job that are less than $20 do not need to be reported.

Note: If you do not report tips, you are subject to a penalty of 50% of the Social Security and Medicare taxes or railroad retirement taxes owed on the unreported tips. The penalty amount is in addition to taxes owed.

If your regular pay is not enough for your employer to withhold taxes owed, then you have until the close of the calendar year to pay the rest of the taxes.

Step 4. Know Where to File Tips on Tax Return?

Tips are reported as wages on form 1040 line 7, form 1040 A line 7, or form 1040 EZ line 1.

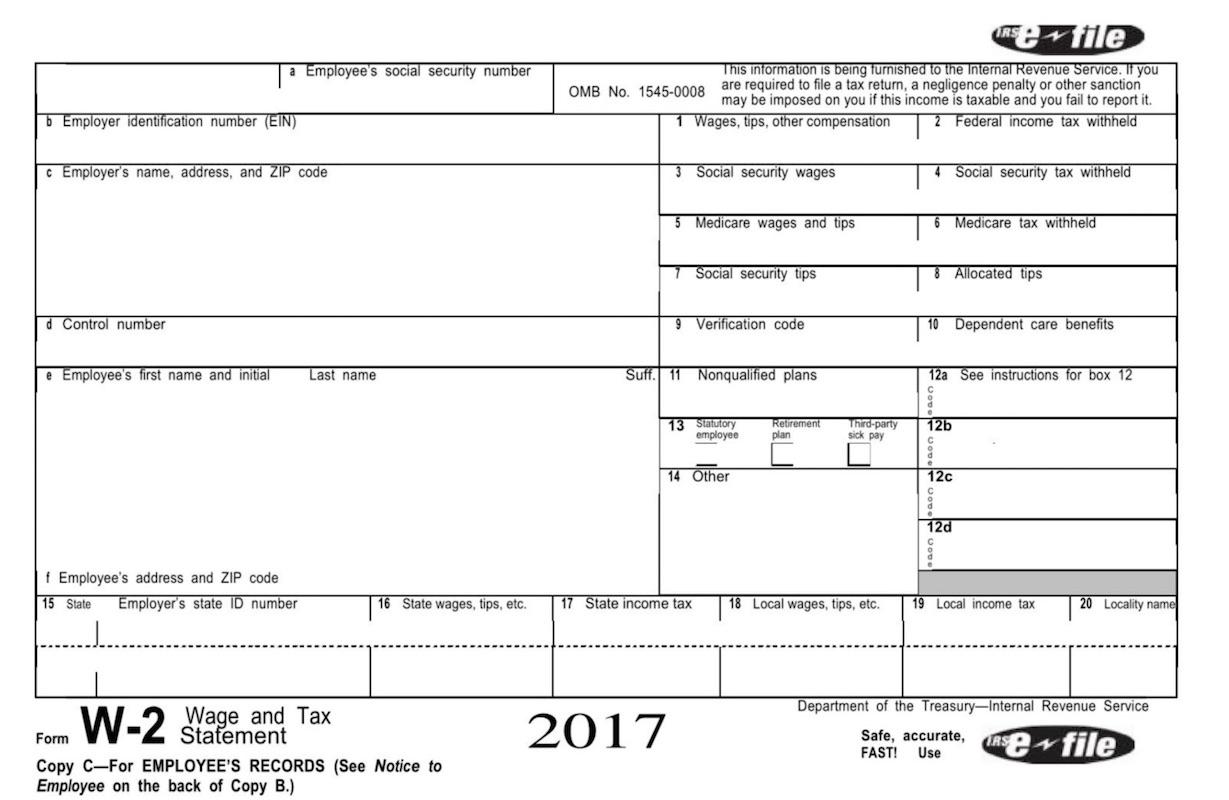

As stated previously, all tips received during the year must be reported on the tax return including both cash tips and non-cash tips. Tips reported to your employer for the year are included in the wages shown in box 1 of your W-2.

Step 5. Add the amount in box 1 to any tips not reported to your employer.

If your employer could not collect all the Social Security and Medicare taxes or railroad retirement taxes owed on tips reported for the year, then the uncollected taxes are shown in box 12 of your W-2 codes A and B.

These amounts must be reported as other tax on the return.

What about allocated tips?

Allocated tips are shown separately on box 8 of your W-2. These tips are not included in box 1 with wages and reported tips. All allocated tips must be reported on your tax return, including both cash and non-cash tips.

Any tips you report to your employer are included in box 1 of your W-2. Any unreported tips, plus allocated tips from box 8, must be added to wages on form 1040, line 7.

No income, Social Security, or Medicare taxes are withheld on allocated tips. Complete form IRS form 4137 and include the allocated tips on line 1 of the form.

Example: Garvey started working for one of the Best Food Restaurants on June 20 and received $12,000 in wages during the year. Garvey kept a daily tip record showing his tips for June where he made $15, but tips for the rest of the year was $8,000.

He was not required to report the June tips to his employer, but he must report the rest of the tips to his employer as required. Garvey’s W-2 from Best Food Restaurant shows $20,000 ($12,000 wages + $8,000 in reported tips) in box 1. He must add the $15 of unreported tips to that amount and report $20,015 as wages on his tax return.

Final Thoughts

I hope this article helped you gain some control of your tax plan this year. Remember not to stress out. Don’t forget to check out Tax Forms page for any additional online tax checklists and forms you may need this year.

If you want more handy tax tips, then feel free to check out my latest articles here. You can sign up to get on the waiting list if you’d like to file with me this year.

If you enjoyed this article, then you’ll love these:

- Best Rules for Claiming a Dependent on Your Tax Return

- Do I Need to File a Tax Return?

- How to Choose the Best Filing Status

- 11 Super Simple Tax Tips for 2021 (Doing Tax Season the Right Way)

- WHERE IS MY REFUND? NEW Federal Tax Law May Affect You

For more money-saving tips and guides, subscribe to the weekly newsletter!

Get started on your taxes early TODAY!

Until the next money adventure, take care!

Handy

Disclaimer Statement: All data and information provided on this site is for informational purposes only. The Handy Tax Guy makes no absolute representation of the correctness, mistakes, omissions, delays, appropriateness, or legitimacy of any information on this site. **Note: Each client circumstance will vary on a case-by-case basis**

(Original Article Date: September 25, 2017/Updated January 16, 2021)